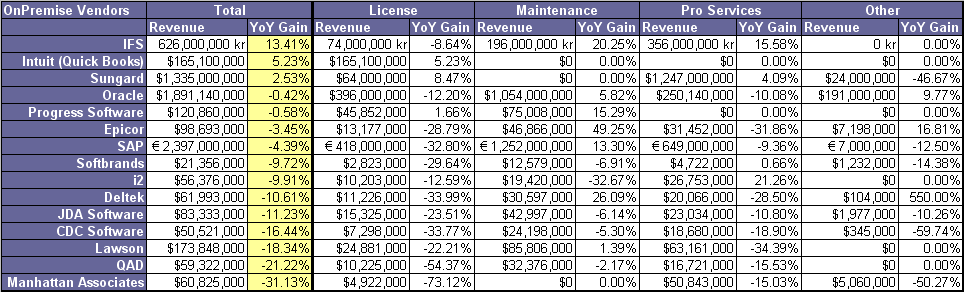

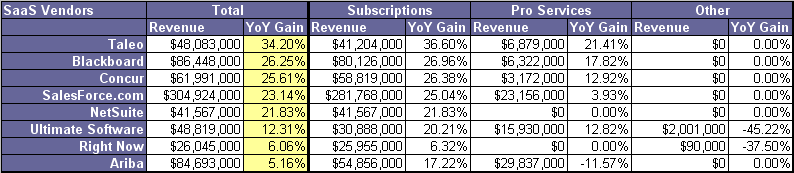

Quarterly Financial Tracker: Q1 CY 2009 Slowdown Impacts All Vendors, SaaS Still Experiencing Strong Double Digit Growth

Most software vendor license revenues took a beating this CY Q1 when compared to 2008. SaaS vendors managed to post double digit gains while only a handful of on premise vendors eeked out a positive gain. Major highlights in the 2009 Calendar Year Q1 include

- Big losses in YoY license revenue for on premise vendors such as Manhattan Associates (-73.12%), QAD (-54.37%), Deltek (33.99%), CDC Software (33.77%), and SAP (32.80%) signal significant long term weakness in attracting new business.

- Few winners in YoY license revenue for on premise vendors. IFS (13.41%), Intuit Quick Books (5.23%), and Sungard (2.53%) showed positive traction amidst a morass of bad news.

- On premise vendors stabilized maintenance revenues from major losses. Some vendors including Epicor (49.25%), Deltek (26.09%), and IFS (20.25%) managed to show significant gains.

- SaaS vendors cleaned house despite the challenging market. Taleo (34.20%), Blackboard (26.25%), Concur (25.61%), Salesforce.com (23.14%), and NetSuite (21.83%), led the growth race in YoY total revenue.

- Growth rates on a YoY basis have slowed for most SaaS vendors, though when factoring the economic forces, these gains reflect truly substantial success.

[caption id="attachment_2390" align="aligncenter" width="800" caption="Software Insider Index® Q1 CY 2009 On Premise Vendors"] [/caption]

[/caption]

[caption id="attachment_2381" align="aligncenter" width="800" caption="Software Insider Index® Q1 CY 2009 SaaS Vendors"] [/caption]

[/caption]

The bottom line - SaaS goes mainstream in 2009 and on-premise vendors must offer hybrid deployment options

SaaS vendor growth continues to defy the ball and chain forces of the macro economy. Though overall growth rates are less than the year before, the SaaS model gains favor with all sizes of enterprises and in all industries. Rapid implementation, subscription pricing model, and constant innovation drive significant interest. This leaves on premise vendors in a precarious situation. Without support for SaaS or other hybrid deployment options, expect customers to wall off their current vendors and pipe in new innovation around the edges with SaaS.

Your POV.

Do you find your vendor sales person becoming more aggressive with their sales tactics? Have you held back on new purchases or upgrades? Is this the year you go full out on SaaS? Feel free to post your comments here or send me an email at rwang0 at gmail dot com .

* Not responsible for any math errors or erroneous revenue information. Calendar year estimates based on the quarter nearest the calendar year. Exchange rates as of February 25th, 2009. Not responsible for currency flux. Please read the quarterly filings yourself =)

R "Ray" Wang

R "Ray" Wang R "Ray" Wang

R "Ray" Wang