Quarterly Financial Tracker: Q4 CY 2009 SaaS Vendors Continue To Trump On Premises Vendors In YoY Growth

The Year Of SaaS Shows... And Yes, In This Economy.

The recession continued to take its toll on software sales with a slight impact to the SaaS vendors. Growth rates have come down from the high 30's to the low 20's. But with "flat" the new growth metric in this down economy, SaaS vendor results remain impressive. On the other hand, traditional on-premises vendors see some light at the end of the tunnel. License revenues have started to stabilize on a year-over-year basis. Major events in the 2009 Calendar Year (CY) Q4 include:

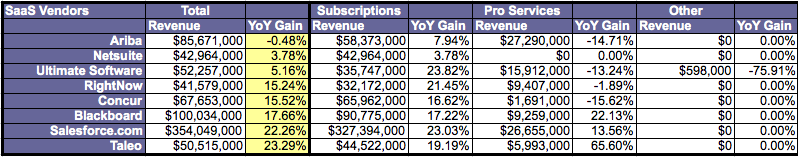

- In YoY quarterly revenue growth, Taleo (23.29%) led the pack followed by SalesForce (22.26%), and Blackboard (17.66%) (see Figure 1).

- Salesforce.com achieves $1.4B in revenues for CY 2009. As the biggest SaaS vendor in the market, Salesforce.com is bigger than Microsoft Dynamics, Lawson, and Unit 4 (Agresso). To put this in perspective, Salesforce.com's revenue alone is at the size of all the other public SaaS vendors listed in the Software Insider Index.

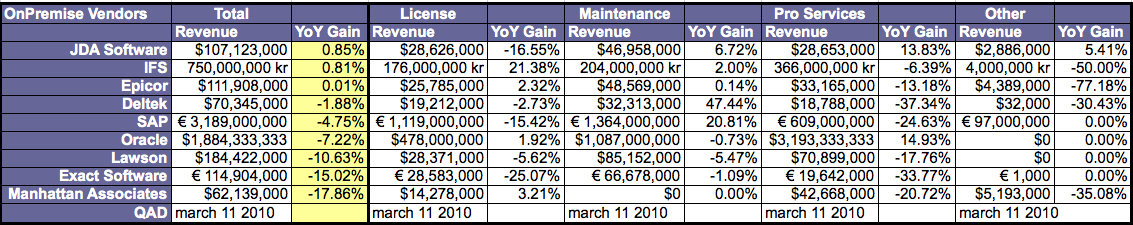

- Most on-premises vendors stabilized declines in new license revenue (see Figure 2). Keep in mind that on-premises vendors have remained profitable in this downturn. Maintenance continues to provide a cash cushion for most on-premises vendors.

- License revenues versus maintenance revenues for some vendors such as Deltek, Epicor, Exact, JDA Software, Lawson Software, Manhattan Associates, and Oracle reach or exceed 1:2 ratios. The result - lagging growth in acquiring new customers on latest releases.

- IFS leads with a (21.38%) gain on YoY license revenue with Manhattan (3.21%), Epicor (2.32%), and Oracle (1.92%) following with positive license revenue for calendar year Q4

Figure 1. Most SaaS Vendors Continue Break Neck Growth

Figure 2. Many On Premises Vendors Rely On Maintenance To Bolster Sagging License Revenues

The Bottom Line - Clients Now Expect On-Premises Vendors To Have A "SaaS" Option

As we tally up the winners and losers for 2009, SaaS vendors have shown to the industry what's required for success in today's tough economic condition. The secret to their success transcends subscription pricing, cloud services, rapid levels of innovation, and point solutions. In fact, the success in SaaS comes from the attention to the relationship and the willingness to take a customer friendly stance. On-premises vendors who have delivered on a partnership with their customers have known this for years. However, they risk being consumed by the new business models of SaaS and Cloud. Customers expect their vendors to deliver hybrid options; and private and public clouds. Expect on-premises vendors without a Cloud deployment option to fade away in this decade as they become the legacy vendors they replaced in the client/server and Internet eras.

Your POV.

As an end user, have you seen the pace of SaaS adoption increase in your organization? Do you continue SaaS solutions with the same level of comfort as on-premises. As a software vendor, do you feel you have the right go-to-market cloud strategy for 2010? Please let us know if you need help with your enterprise apps strategy by:

- Develop your SaaS apps strategy

- Assist with SaaS contract strategies and the Customer Bill of Rights: SaaS

- Improving innovation via SaaS and other deployment options

You can post or send on to rwang0 at gmail dot com or r at softwaresinsider dot org and we’ll keep your anonymity.

* Not responsible for any math errors or erroneous revenue information. Calendar year estimates based on the quarter nearest the calendar year. Exchange rates as of February 24th, 2010. Not responsible for currency flux. Please read the quarterly filings yourself =)

Related resources and links

Take the new and improved survey on 3rd party maintenance

2009 Calendar Year Q3

2009 Calendar Year Q2

2009 Calendar Year Q1

2008 Calendar Year Q4

2008 Calendar Year Q3

2008 Calendar Year Q2

2008 Calendar Year Q1

Copyright © 2010 R Wang and Insider Associates, LLC. All rights reserved.

R "Ray" Wang

R "Ray" Wang R "Ray" Wang

R "Ray" Wang