Monday's Musings: Why On-Premise Vendors and SI's Should Go on the Offense with SaaS

On-premise vendors still see SaaS as a loss leader due to huge ramp up and punishing revenue recognition rules

When it comes to the topic of SaaS, many on-premise vendors appear to be living in denial, hoping that SaaS fails, and/or creating confusion in the market place. These tactics have merit as a shift to SaaS requires plenty of work with minimal return and a destruction - disruption of the current business model. In conversations with 61 vendors and building off of SaaS evangelist Jeffrey Kaplan's post (July 2, 2009, Seeking Alpha - "From the Vendor's Point of View: Why SaaS Sucks"), vendors who have made this transition or have started the investment put in heavy lifting in these activities must:

- Re-architect apps

- Find balance between configuration and optimization of SaaS platform

- Design product road map and rollout strategy

- Determine SLA's

- Identify a hosting strategy

- Craft pricing and licensing policies

- Harmonize SaaS pricing with On-premise and other models

- Create go to market strategy

- Alleviate channel conflict with partners, resellers, distributors

After all this work to be ready for SaaS deployments, vendors also discover that FASB SOP 97-2 software revenue recognition rules prohibit them from immediately recognizing multi-year contracts. Even worse, subscription revenue can only be recognized on a month-to-month basis - leading to a long road to profitability. In fact, vendors such as Lawson, estimated a 7 to 10 year break even period for a full SaaS model. No wonder Harry Debes was fired up on how SaaS could be a fad in his interview with Victoria Ho at ZD Net last year. In private, most software executives also echo such sentiments and wholeheartedly agree with his comments about the business model challenges.

Yet, SaaS adoption moves beyond the Tipping Point in 2009

However, the confluence of recessionary forces, stalled innovation from many on-premise software vendors, and success of early SaaS pioneers such as SalesForce.com and NetSuite has put Software-as-a-Service into the mainstream. Vendors can no longer resist the move to SaaS without negatively impacting their license sales and customer mind share. Additional facts highlight the shift:

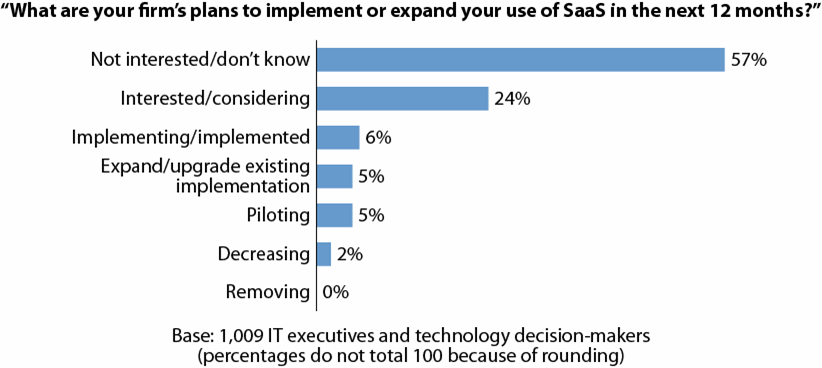

- Forrester State of Enterprise Software 2009 survey results confirm significant adoption rates from 2008 to 2009. Of 1000 IT executives and decision-makers, 24% were interested/considering, 11% implemented or planning to expand, and 5% piloting SaaS solutions (see Figure 1).

- Clients continue to vote with their budgets despite marketing FUD by many on-premise vendors on the perils of SaaS. Success Factors' win at Siemens for 420,000 employees, Workday's win at Flextronics for 240,000 employees, and Ultimate Software's win at P.F. Chiang's for 30,000 employees reinforces how SaaS is more than CRM and SMB.

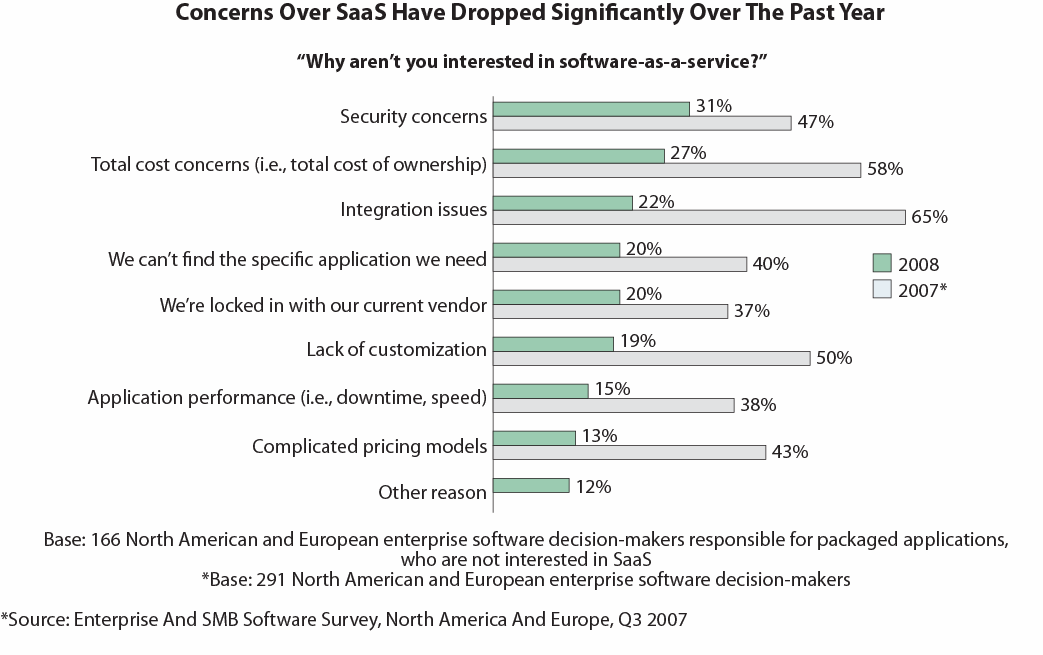

- Concerns over SaaS have dropped significantly over the past year. Successful deployments mitigate concerns and highlight the attitudinal shift towards acceptance. Major decreases include integration issues (43%), total cost (31%), lack of customization (31%), complicated pricing models (30%), performance (23%), can't find the specific application (20%), security (17%), and lock in with existing vendor (17%) (see Figure 2).

Figure 1: Users expect to increase SaaS adoption in 2009

Source: Forrester

Figure 2. Concerns over SaaS have dropped significantly over the past year

Source: Forrester

Defensive SaaS strategies by vendors miss the opportunity to take market share.

As customer's continue to demand SaaS solutions for rapid deployment, pay-as-you-go pricing models, and timely innovation, traditional on-premise vendors without a SaaS offering must now explain, defend, or develop their own SaaS story. Concerns about the impact of SaaS have many vendors in defensive mode. Defensive strategies have included:

- Creating counter marketing about SaaS and the viability of the market

- Responding with hosting options and financing options

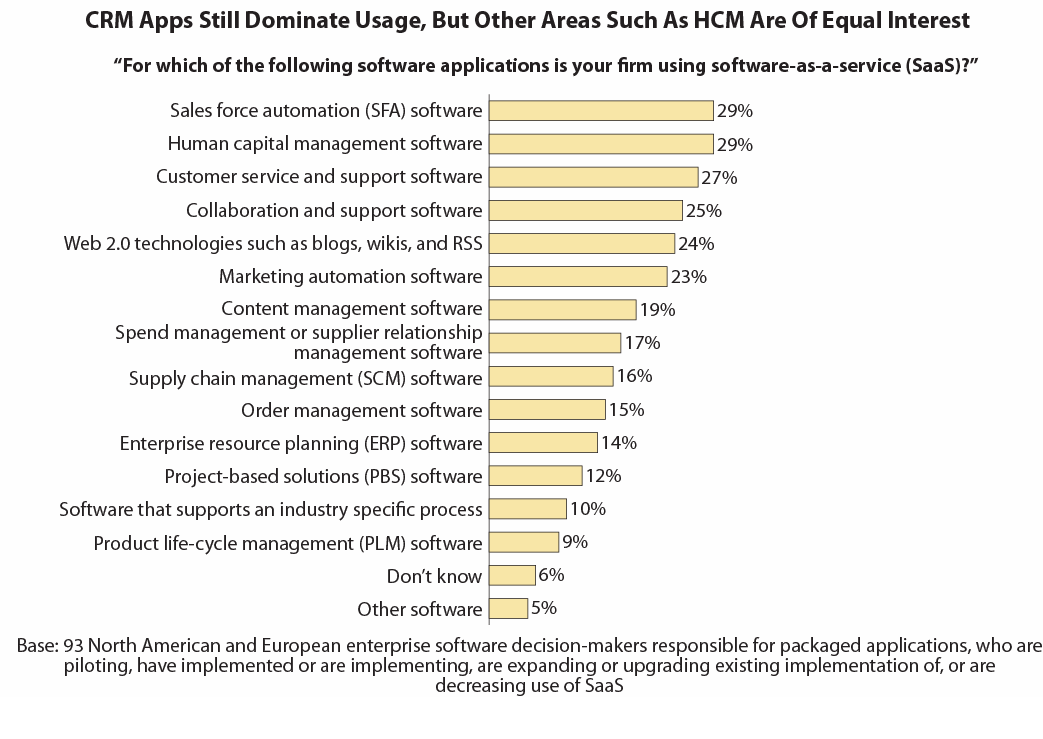

- Building SaaS options for a limited set of popular SaaS solutions such as sales force automation (29%), strategic HCM (29%), and customer service and support (27%) (See Figure 3.)

At first glance, mega vendors such as SAP and Oracle have started with the first two points and are evolving to the third. They aim to counter the success of Ariba, SalesForce.com, Success Factors, Taleo, Workday, and Ultimate Software with their own offerings. SAP's OnDemand for LE release and John Wookey's ComputerWorld UK interview by Mike Simons, confirms that the strategy will include "CRM on-demand and e-sourcing, with expense management set for a 2010 release." Wookey's approach appears to first shore up areas where SAP customers have been defecting and then worrying about what's next (see Note 1). Meanwhile, discussions with Oracle product teams also hint that a release of 5 to 9 SaaS offerings to complement Oracle Siebel CRM OnDemand offerings could be announced soon. This defensive strategy shores up competitive SaaS solutions such as incentive comp, procurement, and strategic HCM.

Figure 3. Rate of adoption of key SaaS solutions show significant interest in CRM and other areas

Source: Forrester

The bottom line -SaaS gives software vendors and system integrators an opportunity to take market share.

Instead of playing defense, vendors should look at the opportunity to take market share through SaaS. SaaS vendors and their investors have realized they can target any install base and win by providing compelling functionality. Why shouldn't on-premise vendors bite the bullet and go on the offense? To make this work software vendors would want to take advantage of their partner ecosystems and customers to extend capabilities beyond what's being delivered in on-premise. Vendors must make an initial investment in a SaaS/PaaS platform, agile development methodologies, and integration technologies to support hybrid deployment options. From there, white spaces in the product road map will provide direction into the future opportunities such as vertical and other pivot points that have not been well served. SAP's acquisition of Clear Standards for carbon compliance, NetSuite's acquisition of OpenAir for project based solutions, and Intuit's acquistion of Entellium for CRM highlights examples of going on the offensive with SaaS. Of equal importance, system integrators can shift the balance of power and deliver new IP via SaaS solutions while reducing their dependency on the mega vendors.

Recommendations: 7 best practices for crafting a SaaS strategy at an on-premise vendor

Imagine you could start from scratch and build a new software company. That's the question I posed to 61 software executives this year. Most stated they would start with a SaaS deployment option for the scale and the business model. Now what to do if you are an on-premise vendor? Answer - build a separate SaaS software division within an on-premise software company. This could be the next trend among the on-premise vendors for both investment and revenue recognition reasons. What would be a good strategy:

- Reuse similar business process parts as the on-premise product

- Harmonize the data model and common objects

- Build a brand new RIA based UI and UX

- Assume that all data sources will be heterogenous

- Design the product to run stand alone

- Attack white spaces of new growth in a competitor's install base

- Keep a PaaS platform in mind to attract partners and customers to extend the solution

Your POV.

Totally turned off by SaaS? In the midst of a SaaS strategy? Ready to embark on a SaaS strategy? If you need assistance, don't hesitate to reach out? Please post your point of view here or send me a private email to rwang0 at gmail dot com.

Note 1: The large enterprise (LE) SaaS platform will not come from NetWeaver or SAP's SME Business by Design (ByD) technology, but come from the acquired Frictionless platform. While this may leave some SAP customers concerned, Wookey and product super stars Kevin Nix and Peter Lim (of Siebel fame) counter by highlighting where SAP components will be reused and highlighting the home base integration advantage.

As also seen in the July 14th, 2009 SandHill.com"Moving to a SaaS Offensive"

Copyright © 2009 R Wang. All rights reserved.

R "Ray" Wang

R "Ray" Wang R "Ray" Wang

R "Ray" Wang