Quarterly Financial Tracker: Q1 CY 2010 - Software's Back With Double Digit Gains In License Growth

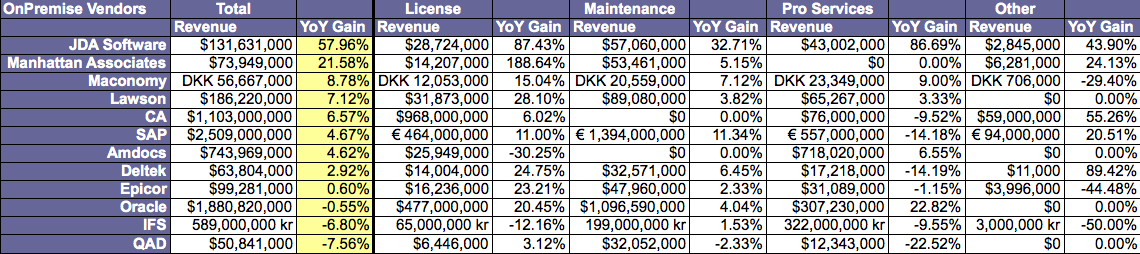

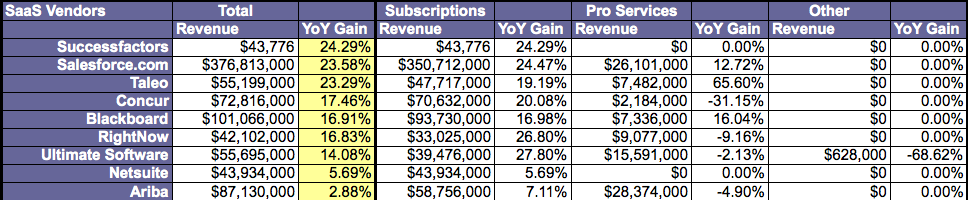

The majority of 21 publicly traded software vendors managed to show year-over-year (YoY) gains over the dismal beating from calendar year (CY) Q1 2009. SaaS vendor maintained their double digit gains while on-premise vendors mostly showed positive traction (see Figure 1) and (see Figure 2). Highlights for the 2010 CY Q1 2010 results:

- Big gains in YoY license revenue for on-premise vendors such as Manhattan Associates (188.64%) and JDA (87.43%) reflect the investments being made in retail and supply chain. Manhattan's gains are the greatest across the board as they demonstrate a turnaround from last year.

- Meanwhile, SMB bell-weathers Lawson (28.10%), Deltek (24.75%), and Epicor (23.21%) signal return of key license sales in on-premise. Concurrently, Oracle (20.45%) and SAP (11.oo%) demonstrate a strong recovery in enterprise license revenue growth in on-premise.

- Maintenance fee growth for on-premise vendors hold steady with mostly single digit YoY gains except JDA Software (32.71%) and SAP (11.34%).

- SaaS vendors kept steady growth in the double digits for subscription revenue. UltimateSoftware (27.80%), RightNow (26.80%), Salesforce.com (24.47%), and SuccessFactors (24.29%) led the charge.

- Overall growth rates on a YoY revenue basis have stabilized for most SaaS vendors at the mid teens to twenties.

- Of interesting note, professional services fees for on-premise vendors match or double the license revenue. SaaS vendor professional services revenue are well below 1x license revenues, closer to 10% or less.

- Figure 1. Software Insider Index® On Premise Vendors: Q1 CY 2010*

- (Right click to view full image)

- Copyright © 2010 R Wang and Insider Associates, LLC. All rights reserved.

- Figure 2. Software Insider Index® SaaS Vendors: Q1 CY 2010*

- (Right click to view full image)

- Copyright © 2010 R Wang and Insider Associates, LLC. All rights reserved

- The Bottom Line - Recovery In Sight Means Lower Discounts In Enterprise Contracts

Good news - new license sales indicate a recovery! Bad news - recovery will mean less discounting in non-competitive renewals. Recent deals indicate that competitive deals in both Enterprise and SMB show that vendors will continue to compete for business. Pricing pressures from the SaaS vendors drive most of the discounting in renewal deals. However, should the recovery continue, expect less concessions in maintenance fee discounts, financing options, maintenance fee price increases, and flexibility in contract policies.

Have you found a change in how your vendor deals with you? Is SaaS influencing how you buy? Feel free to post your comments or send a message to rwang0 at gmail dot com or r at softwareinsider dot org and we’ll keep your anonymity.

Please let us know if you need help with your apps strategy efforts. Here’s how we can help:

- Providing contract negotiations and software licensing support

- Evaluating tech projects for business value

- Assessing apps strategies (e.g. single instance, two-tier ERP, upgrade, custom dev, packaged deployments”

- Designing end to end processes and systems

- Comparing SaaS/Cloud integration strategies

- Assisting with legacy ERP migration

- Planning upgrades and migration

- Performing vendor selection

Disclaimers

* Not responsible for any math errors or erroneous revenue information.

1. Calendar year estimates based on the quarter nearest the calendar year.

2. Why these vendors than others? Easy – because I cover them.

3. Exchange rates as of February 25th, 2010 for vendors who have not published quarterly conversions. Not responsible for currency flux.

4. Estimates created for privately held vendors, when listed.

Not sure? Please read the quarterly filings yourself =)

Related resources and links

Software Insider Index™ (SII): 2009 SII Top 35 Enterprise Business Apps Vendors™

2009 Calendar Year Q4

2009 Calendar Year Q3

2009 Calendar Year Q2

2009 Calendar Year Q1

Software Insider Index™ (SII): 2008Software Insider IndexTM (SII): SII Top 30 Enterprise Business Apps VendorsTM & SII Top SaaS Business Apps VendorsTM SII Top 30 Enterprise Business Apps Vendors™

2008 Calendar Year Q4

2008 Calendar Year Q3

2008 Calendar Year Q2

2008 Calendar Year Q1

Copyright © 2010 R Wang and Insider Associates, LLC. All rights reserved

R "Ray" Wang

R "Ray" Wang R "Ray" Wang

R "Ray" Wang