News Analysis: Oracle Waives Fees On Extended Support Offerings

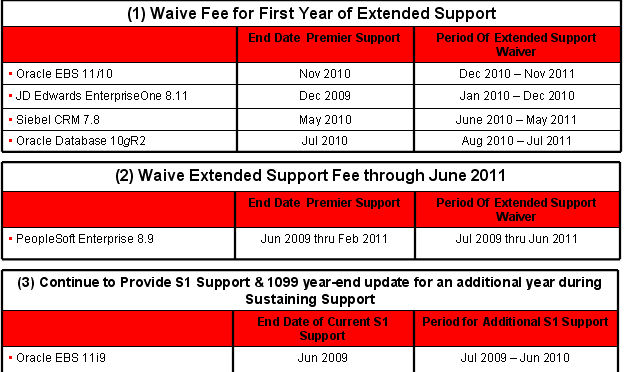

Oracle President Charles Phillips pleasantly surprised Oracle Applications User Group (OAUG) Collaborate 09 attendees this morning during his keynote with the decision to waive Extended Support fees for a number of product lines through 2010 and 2011. As customers and prospects face one of the worst global economic crises, proactive relief on support and maintenance fees could not come at a better time. Summary details of the program can be found in Figure 1.

Figure 1. Oracle's Revised Support Policies

(Source: Oracle Corporation)

Proactive change in support offering creates a win-win

Oracle's move to address the support issue may stem from a variety of reasons but the main focus centers around improving the vendor-client relationship for a few reasons:

- Responding to the global economic crisis. Oracle has taken the initiative in listening to customers, partners, and industry watchers about customer reactions to the escalating costs of software maintenance. Oracle's Applications Unlimited and Lifetime Support Programs have been successful in retaining acquired customers and have shown customers that acquisitions need not be slash and burn with minimal reinvestment.

- Providing more time for customers to adopt Fusion Apps. With the slow down, Oracle may be anticipating slower upgrade rates. While no clear date and product road map has been communicated to customers, removing the price pressure on extended support fees provides customers with some breathing room on upgrade timing.

- Mitigating attention on high profit margins and its M&A strategy. After touting record profit margins near 50% and continuing its M&A strategy with the announcement to acquire Sun, customers have become concerned about the impact of less choice in the market. This move may appease regulators and industry watchers and show that Oracle has some self regulating policies.

The bottom line - user groups should now determine the minimum R&D percentage of investment from revenues

Oracle continues to gain economies of scale with each acquisition. The good news - Oracle has the capacity to reinvest $2.6B per year into R&D and the real dollar amount has increased from 1.9B in 2006. While this is a large figure, the bigger and more important issue - what percentage of the maintenance revenues have been reinvested? Here's where we find a slight drop from 12.6% to about 11.6% in 2008. Consequently, like SAP's users and user groups, OAUG and the other Oracle users and user groups should begin to track the ratio of R&D dollars that tie back to the amount of maintenance revenue. In fact, they may want to take a look at the SUGEN KPI's and see if they are applicable to Oracle's environment. R&D spend from maintenance and the need for Third Party Support options will be the key ownership issues for the next 5 to 10 years. In any case, the need for preserving and strengthening independent user groups will be one effective check and balance in the consolidating world of enterprise software.

Your POV

Do you feel Oracle made the right move? What have your experiences been like with Applications Unlimited and Lifetime Support? Send me a private email to rwang0 at gmail dot com. Posts are preferred! Thanks and looking forward to your POV!

Copyright © 2009 R Wang. All rights reserved.

R "Ray" Wang

R "Ray" Wang R "Ray" Wang

R "Ray" Wang