Research Report: Microsoft Partners - Before Adopting Azure, Understand the 12 Benefits And Risks

![]()

![]()

It's All About The Cloud At WPC10

Attendees at this year's Microsoft Worldwide Partner Conference 2010 in Washington, D.C. already expect Windows Azure development to be a key theme throughout this annual pilgrimage. Microsoft has made significant investments into the cloud. Many executives from the Redmond, WA, software giant have publicly stated that 90% of its development will be focused on the Cloud by 2012. Delivery of the Cloud begins with the Azure platform which includes three main offerings:

- Microsoft Windows Azure

- Microsoft SQL Azure (formerly SQL Services)

- Microsoft Windows Azure Platform: AppFabric (formerly .NET Services).

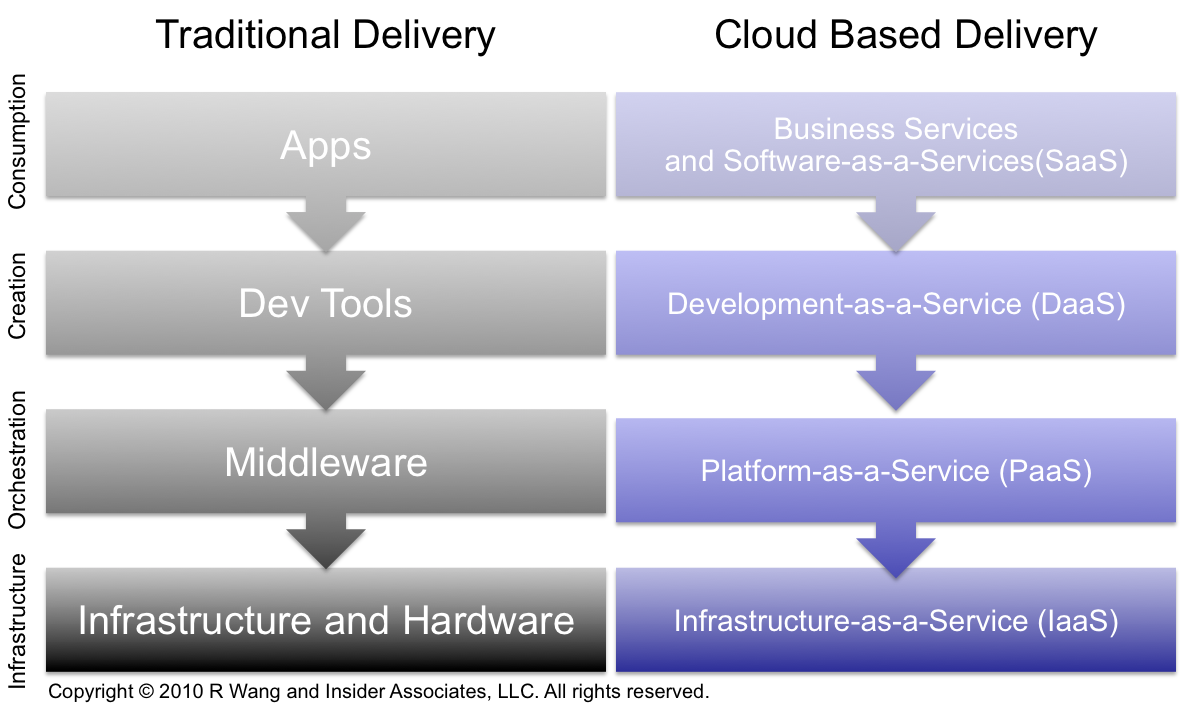

Therefore, Microsoft partners must determine their strategy based on what part of the cloud they plan to compete in and which Azure services to leverage. As with any cloud platform, the four layers include infrastructure, orchestration, creation, and consumption (see Figure 1):

- Infrastructure. At a minimum, Windows Azure provides the infrastructure as a service. Data center investments and the related capital expense (capex) is replace with oeprational expenses (opex). Most partners will take advantage of Azure at the infrastructure level or consider alternatives such as Amazon EC2 or even self provision hosting on partner servers and hardware.

- Orchestration. Microsoft Windows Azure Platform: AppFabric delivers the key "middleware" layers. AppFabric includes an enterprise service bus to connect across network and organizational boundaries. AppFabric also delivers access control security for federated authorization. Most partners will leverage these PaaS tools. However, non-Microsoft tools could include advanced SaaS integration, complex event processing, business process management, and richer BI tools. The Windows AppFabric July release now supports Adobe Flash and Microsoft SilverLight.

- Creation. Most partners will build solutions via VisualStudio and Microsoft SQL Azure (formerly SQL Services). Other creation tools could include Windows Phone7 and even Java. Most partners expect to use the majority of tools from Microsoft and augment with third party solutions as needed.

- Consumption. Here's where partners will create value added solutions for sale to customers. Partners must build applications that create market driven differentiators. For most partners, the value added solutions in the consumption layer will provide the highest margin and return on investment (ROI).

.NET:.NET (tongue and cheek here) - Microsoft partners and developers can transfer existing skill sets and move to the cloud with ease, once Microsoft irons out the business model for partners on Azure.

Figure 1. Partners Must Determine Which Layer To Place Strategic Bets

Azure And Cloud Deployment Brings Many Benefits...

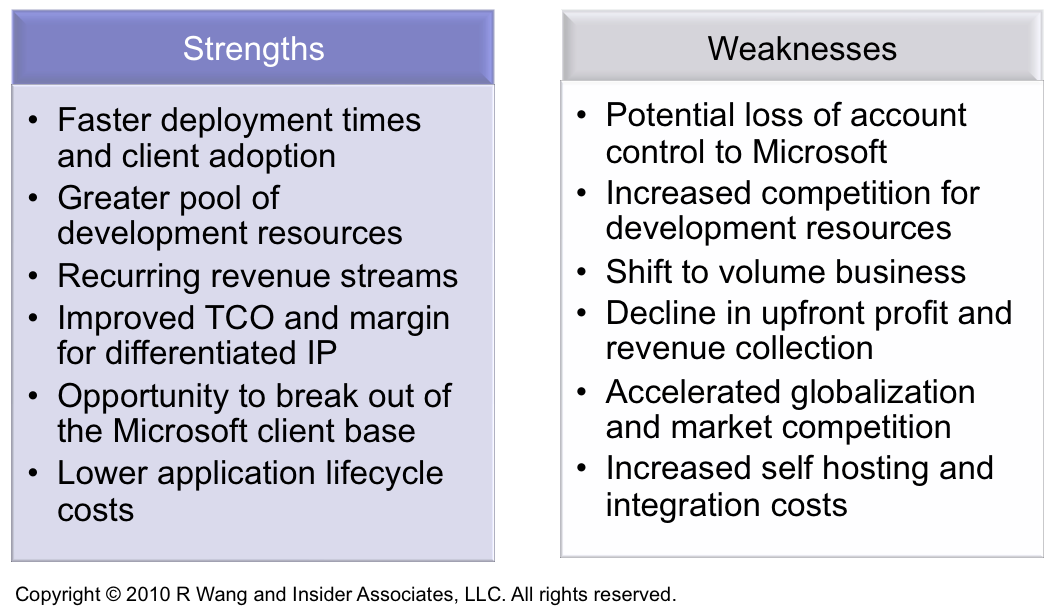

As cloud adoption gains favor with many clients and industries, Microsoft Partners must consider when to begin investment in Azure. In conversations with over 71 partners, identified benefits can be grouped into six areas that include:

- Faster deployment times and client adoption. Seven Cloud/SaaS benefits include richer user experience, rapid implementation, frequent cycles of innovation, minimal upgrade hassles, always on deployment, subscription pricing, and scalability. These benefits lead to faster client adoption and greater usage in an organization. Partners can reduce travel expenses per client. Clients can increase time to go-live.

- Greater pool of development resources. Partners can expect to find a rich source of development talent. Existing Microsoft developers on VisualStudio and other Microsoft tools can participate in Azure development projects with ease. Partners will increase globally sourced expertise. Development resources will specialize over time and create centers of excellence.

- Recurring revenue streams. A key component of SaaS/Cloud is utility pricing. Partners that build IP and solutions will move to a more stable subscription revenue model. Most billing will move from upfront to monthly or quarterly.

- Improved TCO and margin for differentiated IP. The cost of development and time to market will decrease. The result - improved margins and better ROI for new product development. Partners can test scenarios with the Microsoft Azure ROI calculator.

- Opportunity to break out of the Microsoft client base. Partners who build SaaS/Cloud solutions can market to any customer in the world. Customers don't care what database, application development platform, or technology stack partners use in the cloud. Clients only care about service level agreements and contractual obligations.

- Lower application lifecycle costs. Partners benefit directly from a one-to-many delivery. A code change, regulatory update, or bug fix delivered once will apply to all customers in a multi-tenant model. For those going with single instance hosting, at least application management costs will be reduced.

...Yet Cloud Models Create New Channel Partner Risks

However, with the benefits come some potential channel risks to partners. While none of these risks are insurmountable, partners must take caution and note as they plan out their go-forward partnership strategy. The six risks identified by 71 partners in moving to Azure include:

- Potential loss of account control to Microsoft. Partners who host with Microsoft remove a key barrier in the partner relationship - account control. Customers for the first time will directly work with Microsoft via hosting through Azure. Partners should lobby hard for policies that keep the balance within the hands of the partners or risk losing long term account control.

- Increased competition for development resources. With global access, partners face the double edged sword in securing resources. A number of marginal players will emerge but competition for A-players will be fierce as partners ramp up.

- Shift to volume business. Partners must think about how to build offerings for volume deployments. Faster deployments will result in the need to increase the volume to make up for lower revenues. Scaling repeatable offerings will improve profit margins.

- Decline in upfront profit and revenue collection. Partners used to half of the payments upfront and the rest upon delivery will have to adjust to cash flow changes with subscription billing. Cash flow issues will increase and cap ex for reinvestment and development will decline.

- Accelerated globalization and market competition. With SaaS/Cloud, every partner, ISV, and SI solution offering is competing for mind share. Competition for solutions goes global, cross-platform, and cross industry. Partners must prepare to compete for mind share among all the technology vendors offering solutions.

- Increased self-hosting and integration costs. Partners that self-host will face long term cost challenges. As Microsoft, Amazon, and Google build out large scale data centers, their cost of delivery will reach 1/10th of a partner's ability to host by 2015. Moreover, data, process, and metadata integration among various cloud platforms remains the most complex challenge. Partners who can not scale in integration and data center costs will find themselves burdened with a new legacy cost structure.

Figure 2. The Advantages And Disadvantages Of Azure For Partners

The Bottom Line For Microsoft Partners - Success Requires A Focus On Differentiated IP Creation

The Bottom Line For Microsoft Partners - Success Requires A Focus On Differentiated IP Creation

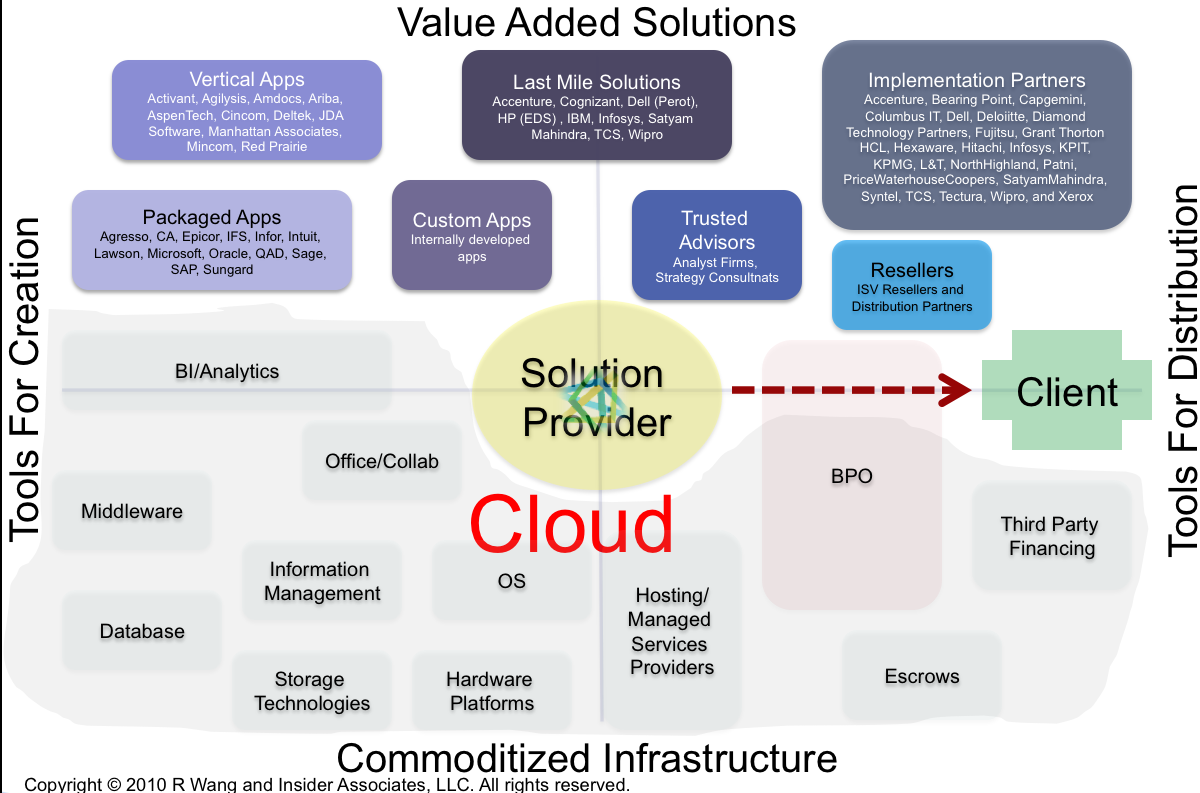

As market momentum increases for Cloud solutions, partners must make the transition to new business models. The commoditization of key components in the solution ecosystem accelerates with commoditized solutions across both the tools f0r creation and the tools for distribution (see Figure 3.) Consequently, new profit pools will emerge as partners invest in verticalized solutions, geographic expertise, and role tailored experiences. The result - partners must focus on building differentiated IP or face rapid margin deterioration. With new solutions in tow, the Cloud will allow partners to go on a SaaS offensive and grow into markets that previously were walled off because of cultural, architectural, technical, and geographical barriers.

Figure 3. Cloud Models Force Partners Into Value Added Solutions In The Race For the Largest Chunk Of The Technology Budget

Your POV

Microsoft Partners, what’s your view on SaaS vs Cloud and Azure? Ready to embrace Azure as a key investment and opportunity? Are you looking at private, public, or hybrid cloud options? Add your comments to the discussion or send on to rwang0 at gmail dot com or r at softwaresinsider dot org and we’ll keep your anonymity.

Please let us know if you need help you and your clients with SaaS/Cloud strategies. Here’s how we can help:

- Crafting a next gen apps strategy

- Short listing and vendor selection

- Contract negotiations support

- Market evaluation

- Implementation partner selection

- Connecting with other partners

- Sharing best practices

- Designing a next gen apps strategy

- Providing contract negotiations and software licensing support

- Demystifying software licensing

Resources And Related Research:

- 20100621 A Software Insider's POV - R "Ray" Wang - "Research Report: How SaaS Adoption Trends Show New Shifts In Technology Purchasing Power"

- 20090714 Sandhill.com – R “Ray” Wang – “Opinion: Moving to a SaaS Offensive”

- 20100322 A Software Insider’s POV – R “Ray” Wang -”Understanding The Many Flavors Of Cloud Computing/SaaS”

- 20100125 A Software Insider's POV - R "Ray" Wang - "Monday's Musings: The Hidden Value In SaaS Deployments"

- 20091222 A Software Insider’s POV – R “Ray” Wang “Tuesday’s Tip: 10 Cloud And SaaS Apps Strategies For 2010″

- 20091208 A Software Insider’s POV – R “Ray” Wang – “Tuesday’s Tip: 2010 Apps Strategies Should Start With Business Value”

- 20091012 A Software Insider’s POV – R “Ray” Wang – “Research Report: Customer Bill of Rights – Software-as-a Service”

- 20090602 A Software Insider’s POV – R “Ray” Wang ” Tuesday’s Tip: Now’s The Time To Consider SaaS Software Escrows”

- 20081028 A Software Insider’s POV – R “Ray” Wang “Tuesday’s Tip: SaaS Integration Advice”

Reprints

Reprints can be purchased through the Software Insider brand or Altimeter Group. To request official reprints in PDF format, please contact [email protected].

Disclosure

Although we work closely with many mega software vendors, we want you to trust us. Microsoft is currently a client of Altimeter Group but not of Insider Associates, LLC. For the full disclosure policy please refer here.

Copyright © 2010 R Wang and Insider Associates, LLC. All rights reserved.

R "Ray" Wang

R "Ray" Wang R "Ray" Wang

R "Ray" Wang