Event Report: Dell's Annual Analyst Conference Highlights Enterprise Software Future

Annual Analyst Conference Highlights The New Dell Strategy

Dell held their annual analyst conference at The W Austin from May 3rd to May 4th, 2011. The event featured multiple sessions including:

- Services and Solutions For The Vitual Era

- Data Center and Information Management - Trends & Business Issues - moderated by Brad Anderson Senior Vice President of Enterprise Solutions

- A Side of Dell You May Not Know - moderated by Karen Quintos, Senior Vice President and CMO

- CEO Perspective

- Extending Dell's Enterprise Solutions & Services - moderated by Michael Dell (@michaeldell)

- Solutions Services Strategy Update

Figure 1. Flickr Feeds From Dell Annual Analyst Conference 2011

(Tag your images with #softwareinsider or #rwang0 to include into the feed)

Big themes at the event focused around the consumerization of IT (CoIT). Dell's revamped strategy responds to big trends such as the adoption of social media, changing workplace norms, proliferation of devices, and consumption of IT by end users. Key messages from a software point of view across the consumer, SMB, mid-sized, and large enterprise markets highlighted a:

- Dedication to BRIC and emerging markets. BRIC markets sustained market share and grew revenue at 17% during the downturn. In fact, Dell held a #1 market share in India and #3 in China and Brazil.

Point of View (POV): Emerging markets play well into the Dell mid-market heritage. More importantly, developed markets have mostly tapped out. Double digit growth will come to technology firms who master the international markets.

- Investment in cloud computing. Initial strategies address the IT buyer, developers and end users. Dell intends to attack the related services market with remote infrastructure management outsourcing(RIMO), cloud services, and transformation consulting. On the apps side, SaaS, cloud re-platforming, and cloud migration play big roles in future strategy.

POV: While discussions around cloud focus mostly on the infrastructure layers, private conversations paint a picture of investment in Platform-as-a-Service (PaaS) and SaaS applications. Expect Dell to make more investments to bring solutions to market via the cloud.

- Commitment to open solutions. Dell plans to ensure that all its acquired products and existing solutions maintain an open architecture. Part of the strategy includes support for heterogeneous environments, virtual integration, and minimized technology lock-in.

POV: Dell claims that moving from proprietary to open systems, organizations can go from 300 servers per admin to 6000 severs per admin. Storage savings shift from $2.20 per GB/month to $0.40 per GB/month. However, delivering open systems will require a lot of engineering investment among competitors not seeking to stay open.

- Upsell into software. Strong channel and direct success in the hardware market opens up opportunities to sell systems management (Kace), cloud integration (Boomi), data management (Compellent and EqualLogic), and security software (Secureworks).

POV: Dell's direct channels have proven that they can drop product into pipe and be successful. For example, KACE grew revenues 400% since acquisition. Long term, Dell must learn a software culture to be successful. Not too many hardware vendors have made this transition.

Dell's Acquisition Path Sets The Stage For Ecosystem Expansion

Since January 2008, Dell's made ten acquisitions that pivot the company portfolio towards services and software (see Figure 2):

- EqualLogic - Storage Area Networks

- The Networked Storage Company - Auditable end to end storage services

- Message One -Email Management and Crisis Management Services

- Perot Systems - BPO and IT services provider

- KACE Networks - Applianced based systems management

- Exanet - NAS for HPC

- Ocarina Networks - Best of breed storage deduplication

- Boomi - Cloud integration

- Compellent -Virtualized storage platform

- SecureWorks - Security as a Service

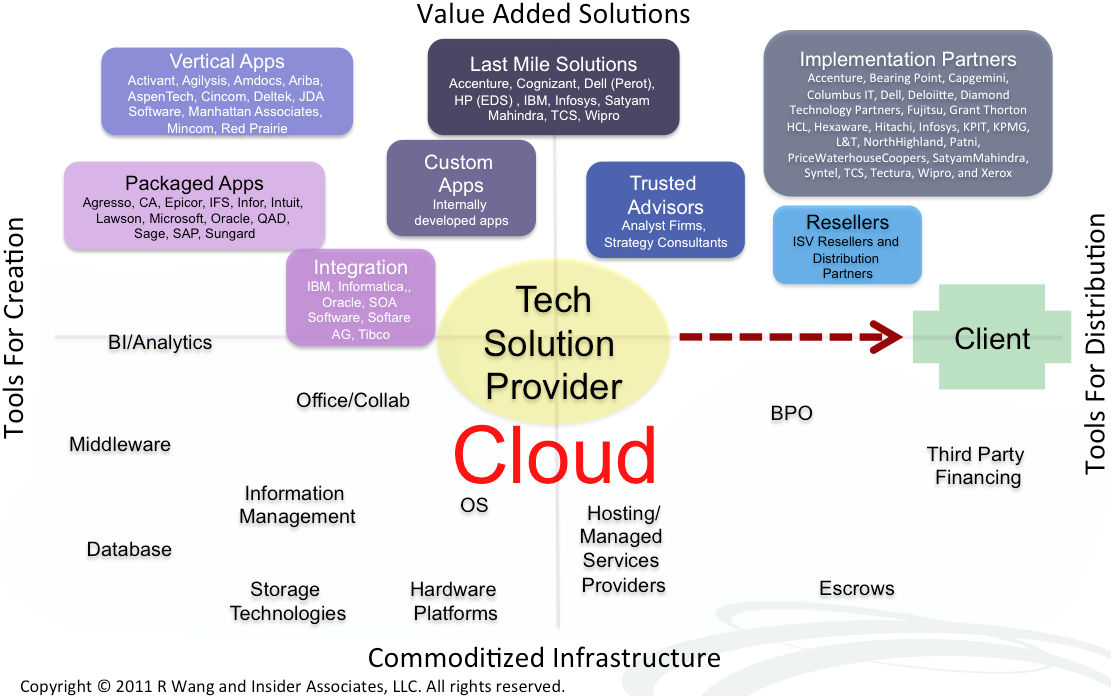

Dell's slowly amassing components required to play in Cloud Infrastructure, Platform as a Service, and Software as a Service (see Figure 3). A move to the cloud shifts product and solution offerings from commoditized infrastructure to value added solutions. Mid-market customers should benefit the most.

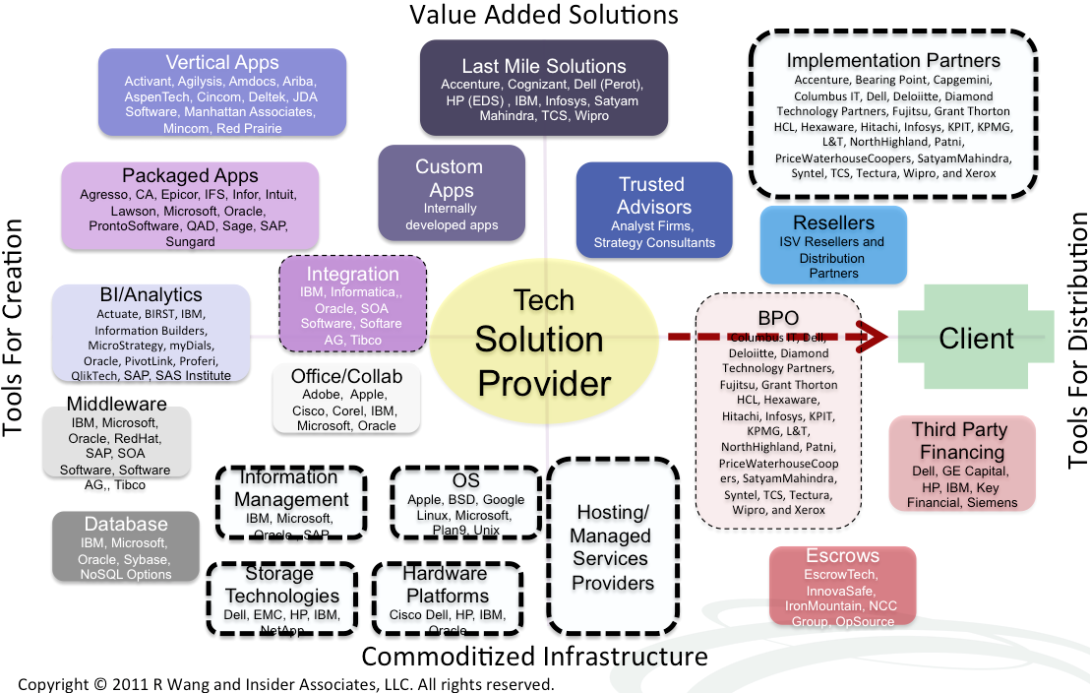

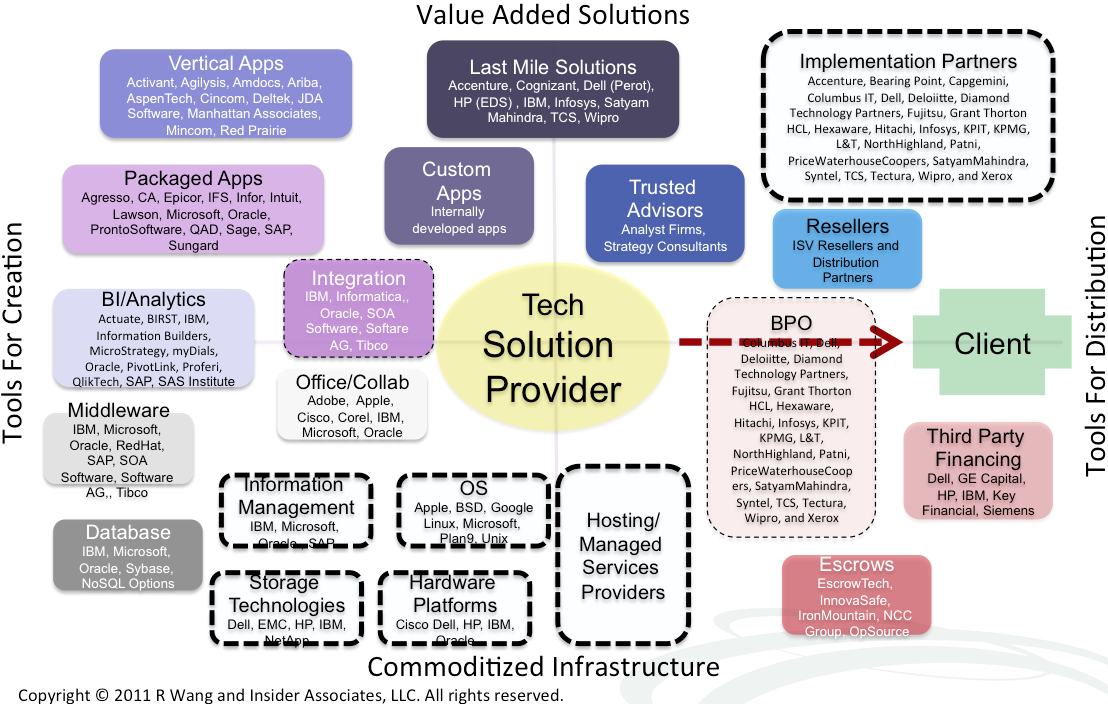

Figure 2. Dell Adds Storage, Integration, BPO, And Cloud To The Software Insider Tech Ecosystem Model

Figure 3. Shift To Cloud Puts Dell's Focus On Creating Value Added Solutions

The Bottom Line: Dell Will Make The Shift From Hardware To Software By 2015

While slow to market, Dell's recent acquisitions and company messaging hint at this shift. As traditional hardware companies seek higher margins, most have already acquired services arms. Consequently, the next logical step requires the hardware vendors to get into software. Software margins hover from 10% to 50% depending on the market. Dell's making big bets in the cloud starting with storage and integration. Dell customers can expect a slew of additional solutions to emerge as the cloud infrastructure provides the platform for future software delivery.

Your POV.

Ready to buy software solutions from Dell? Are you a storage customer today? What do you think of Dell's acquisitions to date? Add your comments to the blog or reach me via email: R (at) ConstellationRG (dot) com or R (at) SoftwareInsider (dot) com.

Please let us know if you need help with your next gen apps strategy, overall apps strategy, and contract negotiations projects. Here’s how we can help:

- Designing a next gen apps strategy

- Providing contract negotiations and software licensing support

- Demystifying software licensing

- Assessing SaaS and cloud

- Evaluating Cloud integration strategies

- Assisting with legacy ERP migration

- Planning upgrades and migration

- Performing vendor selection

- Renegotiating maintenance

Resources And Related Research:

20100621 A Software Insider's POV - R "Ray" Wang - "Research Report: How SaaS Adoption Trends Show New Shifts In Technology Purchasing Power"

20100322 A Software Insider’s POV – R “Ray” Wang -”Understanding The Many Flavors Of Cloud Computing/SaaS”

20091222 A Software Insider’s POV – R “Ray” Wang “Tuesday’s Tip: 10 Cloud And SaaS Apps Strategies For 2010″

20091208 A Software Insider’s POV – R “Ray” Wang – “Tuesday’s Tip: 2010 Apps Strategies Should Start With Business Value”

20091012 A Software Insider’s POV – R “Ray” Wang – “Research Report: Customer Bill of Rights – Software-as-a Service”

20090714 Sandhill.com – R “Ray” Wang – “Opinion: Moving to a SaaS Offensive”

20090602 A Software Insider’s POV – R “Ray” Wang ” Tuesday’s Tip: Now’s The Time To Consider SaaS Software Escrows”

20081028 A Software Insider’s POV – R “Ray” Wang “Tuesday’s Tip: SaaS Integration Advice”

Next In The Series

Reprints

Reprints can be purchased through Constellation Research, Inc. To request official reprints in PDF format, please contact sales (at) ConstellationRG (dot) com.

Disclosure

Although we work closely with many mega software vendors, we want you to trust us. For the full disclosure policy, stay tuned for the full client list on the Constellation Research website.

Copyright © 2011 R Wang and Insider Associates, LLC All rights reserved.

R "Ray" Wang

R "Ray" Wang R "Ray" Wang

R "Ray" Wang