News Analysis: Lithium Technologies Adds $53M in Financing

New Funding Shows Strength In Social Business Market And Lithium's Business Model

Emeryville, California based Lithum Technologies announced today that it raised $53.4M in financing. The lead round is from New Enterprise Associates (NEA). Other investors include SAP Ventures.

- NEA leads the round with Peter Sonsini joining the board. Peter's been active with ecommerce play BeachMint, community platform BuzzMedia, ruby development player Engine Yard, and cloud player Eucalyptus. Of note all "existing Lithium investors, including Benchmark Capital, DAG Ventures, Emergence Capital, Greenspring Associates, Shasta Ventures and Tenaya Capital" participated in this D round.

Point of View (POV): NEA's traditionally gone in early and invested with visionary entrepreneurs. However, this play fits along its second investment thesis for venture growth equity opportunities. NEA's track record bodes well for Lithium should they decide to go the IPO route. More importantly, NEA provides Lithium with a vast network of resources for both sales, business development, and expansion.

- Lithium's executed well amidst an increasingly competitive landscape. Lithium has shown growth into key verticals including auto, consumer products, financial services, retail, technology, telecommunications, and travel and leisure. Key wins and expansions include BskyB, McDonalds, Nestle, Nissan, SuccessFactors and Telstra.

Point of View (POV): Expansion into key verticals, improvement in SaaS upgrade technology, and the addition of enterprise class executives such as Rob Tarkoff, Ed Van Siclen, and Jim Drill show a seriousness to take the company to the next level. The social business sale is starting to expand beyond the CMO role and across other line of business executives. As the sale touches across the enterprise, the new management team is better positioned to address the needs of CIOs, CFO's, and other line of business execs as well as agency and system integrator partners. More importantly, Lithium can expect consolidation in the market and increased competition from Jive, Salesforce.com, IBM, and others to heat up.

The Bottom Line For Customers: New Financing Validates Your Investment With Lithium Technologies

The strength and size of the additional financing validates Lithium's position in the market place and bodes well for both existing customers and prospects. Lithium intends to expand its role in defining the social customer experience. This round of additional financing enables Lithium to:

- Support new social business use cases

- Expand into new markets such as digital agency ecosystem and growing geographies

- Invest in more research and development

- Fund future acquisitions

- Improve service delivery for existing customers

The market place is about to consolidate and the additional funding ensures stability at Lithium as well as reaffirms its position among the leaders in social customer experience and the broader category of social business.

The Bottom Line For Technology Vendors: Expect Consolidation Across The Vendor Landscape In 2012

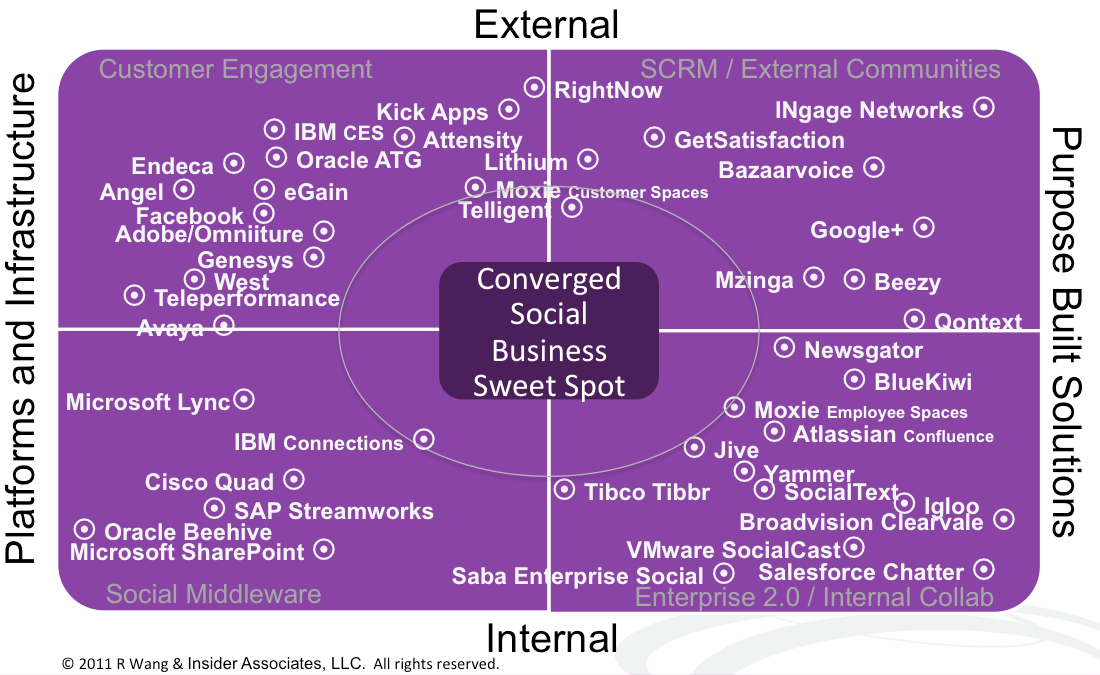

Activity around social business deals have accelerated in the last three months. Jive's IPO has provided this market category with a catalyst for continued investment. More importantly, key fundamentals such as increasing customer adoption, continued market share gains by start-ups and pure-play vendors, and interest by established software vendors indicate the beginning of a mergers and acquisition cycle in 2012. Technology vendors can expect deals and partnerships as each of the Social Business software categories: Customer engagement, SCRM/ External Communities, Enterprise 2.0/Internal Collaboration, and Social Middleware combine to address the 43 use cases of social business. The market can expect the following combinations:

- Established CRM vendors to add social offerings

- Social middleware vendors to move up the stack

- Consolidation of SCRM players with Enterprise 2.0 communities

- Expansion of SCRM vendors into other CRM areas

Figure 1. Expect Consolidation Across The Vendor Landscape In Social Business For 2012

Your POV.

Are you ready for Social Business? If you are a Lithium customer, what do you think? Got a question? Add your comments to the blog or reach me via email: R (at) ConstellationRG (dot) com or R (at) SoftwareInsider (dot) com.

Please let us know if you need help with your Social CRM/ Social Business efforts. Here’s how we can assist:

- Assessing social business/social CRM readiness

- Developing your social business/ social CRM strategy

- Vendor selection

- Implementation partner selection

- Connecting with other pioneers

- Sharing best practices

- Designing a next gen apps strategy

- Providing contract negotiations and software licensing support

- Demystifying software licensing

Related Research:

- Monday’s Musings: Balancing The Six S’s In Consumerization Of IT

- Monday’s Musings: A Working Vendor Landscape For Social Business

- Product Review: Google+, Consumerization of IT, and Crossing The Chasm For Enterprise Social Business

- Monday’s Musings: Using MDM To Build A Complete Customer View In A Social Era

- Monday’s Musings: Mastering When and How High End Brands Should Use Daily Deal Sites Such As Groupon

- News Analysis: Salesforce.com Acquires Radian6 For $316M

- Monday’s Musings: Q1 2011 State of Social CRM and CRM From An EMEA Point Of View

- Best Practices: Applying Social Business Challenges To Social Business Maturity Models

- Research Summary: Software Insider’s Top 25 Posts For 2010

- Best Practices: Five Simple Rules For Social Business

- Research Report: Constellation’s Research Outlook For 2011

- Research Report: How The Five Pillars Of Consumer Tech Influence Enterprise Innovation

- Research Report: Next Gen B2B and B2C E-Commerce Priorities Reflect Macro Level Trends

- News Analysis: Jive Fills Warchest, Ready to Battle Enterprise Software Giants And IPO?

- Tuesday’s Tip: Applying The Five Stages Of Adoption Towards SCRM Projects

- News Analysis: Lithium’s Acquisition of Scout Labs Ups The Ante in Social CRM

- News Analysis: Biz360 Acquisition Signals Attensity Group’s Move Into Social CRM

- Monday’s Musings: Avoiding Failure In Social CRM Projects Requires Ecosystem Coordination

- Research Report: The 18 Use Cases of Social CRM – The New Rules of Relationship Management

- News Analysis: Siperian Acquisition Vaults Informatica Into An MDM Leadership Position

- News Analysis: Jive and Radian6 Partner – Great For Business, But Could Fragment IT Systems

- Event Report: Salesforce.com Pushes Social CRM Technology — But Don’t Expect Companies To Be Successful With Tools Alone

- Monday’s Musings: Why Every Social CRM Initiative Needs An MDM Backbone

- Personal Log: Altimeter Group – Helping Organizations Bridge The Technology Obsolescence Gap

- Monday’s Musings: 10 Essential Elements For Social Enterprise Apps

Reprints

Reprints can be purchased through Constellation Research, Inc. To request official reprints in PDF format, please contact sales (at) ConstellationRG (dot) com.

Disclosure

Although we work closely with many mega software vendors, we want you to trust us. For the full disclosure policy, see the full client list on the Constellation Research website.

Copyright © 2012 R Wang and Insider Associates, LLC All rights reserved.

R "Ray" Wang

R "Ray" Wang R "Ray" Wang

R "Ray" Wang