Quarterly Financial Tracker: Q3 CY 2009 SaaS Vendors Face Some Headwinds, On-Premise Still In The Tank

Purchasing in Q3 reflected both economic downturn and summer doldrums. While on-premise vendors continued massive double digit declines in year-over-year new license revenue, SaaS vendors faced some pressures in keeping up with tremendous growth. However, long term economic outlook still favor SaaS players and early indications on Q4 budget flush indicate that SaaS and Cloud are top of mind. Major themes in the 2009 Calendar Year Q3 include:

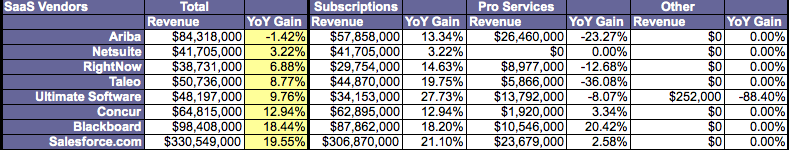

- On the SaaS front, Salesforce.com (19.55%) continues to lead the pack followed by Blackboard (18.44%) and Concur at (12.94%) (see Figure 1). While SaaS vendors still experienced growth, Concur (12.94%), Ultimate Software (9.76%), and Taleo (8.77%), NetSuite (3.22%) experienced drops in rate of growth. Taleo and NetSuite faced the biggest drops in Q3.

- Tracked publicly traded SaaS vendors represented $756.2M in Q3 software revenues.

- On-premise vendors showing gains in EPS despite revenue drops (see Figure 2).

- Specialty on-premise vendors JDA Software (-2.63%) and IFS (-5.07%) reversed license growth and lost year-over-year quarterly gains.

- Lawson Software reversed a license free fall showing growth in Q3 (22.77%). Healthcare and HCM continued to bolster its license growth and come back.

- Maintenance revenues continue to float losses in license revenue for on-premise vendors. Growth in maintenance continues to slow.

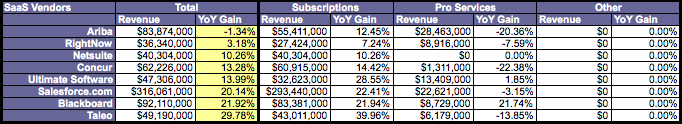

Figure 1. SaaS Vendors Face Q3 Headwinds And Growth Slows Vs Q2

2009 Q3 Calendar Year SaaS Revenues

[caption id="attachment_3742" align="alignnone" width="789" caption="2009 Q3 Calendar Year SaaS Revenues - Copyright © 2009 R Wang and Insider Associates, LLC. All rights reserved."]

[/caption]

2009 Q2 Calendar Year SaaS Revenues

[caption id="attachment_3743" align="alignnone" width="798" caption="2009 Q2 Calendar Year SaaS Revenues - Copyright © 2009 R Wang and Insider Associates, LLC. All rights reserved."]

[/caption]

Figure 2. On-premise Vendors Face Continued Market Brutality

[caption id="attachment_3746" align="alignnone" width="934" caption="2009 Q3 Calendar Year On-Premise Revenues - Copyright © 2009 R Wang and Insider Associates, LLC. All rights reserved."][/caption]

The Bottom Line For Users - Expect Continued Discounts in Q4

A poor Q3 will bring good news to buyers in Q4 as vendors will continue to heavily discount licenses and professional services while delivering more value to retain maintenance margins. Conversations with 41 CIO's indicate that a Q4 budget flush is in the works. The conditions favor end users as poor economic conditions, realization by vendors, and need to invest will yield a great buying season.

The Bottom Line For Vendors - Start The Subscription Revenue Model Shift

It's time to go on a SaaS offensive. The train has left, but its not too late. Expect hardware vendors, telecom providers, and other companies looking to gain software multiples to enter the market via SaaS. 2010 will bring significant acquisitions in this space as well as more proliferation of SaaS offerings and PaaS delivery models. Best of breed solutions delivered via SaaS will cut into on-premise market share. Cloud computing will not be an end all be all. Hybrid deployment will continue to be the norm.

Your POV.

Ready for some great renewal conversations in Q4? Feel free to post your comments here or send me an email at rwang0 at gmail dot com for any assistance in contract negotiations with your vendor or the development of a software licensing and pricing strategy for 2010.

* Not responsible for any math errors or erroneous revenue information. Calendar year estimates based on the quarter nearest the calendar year. Exchange rates as of November 189th, 2009. Not responsible for currency flux. Please read the quarterly filings yourself =)

R "Ray" Wang

R "Ray" Wang R "Ray" Wang

R "Ray" Wang