Tuesday's Tip: When To Go With A Two-Tier ERP Strategy

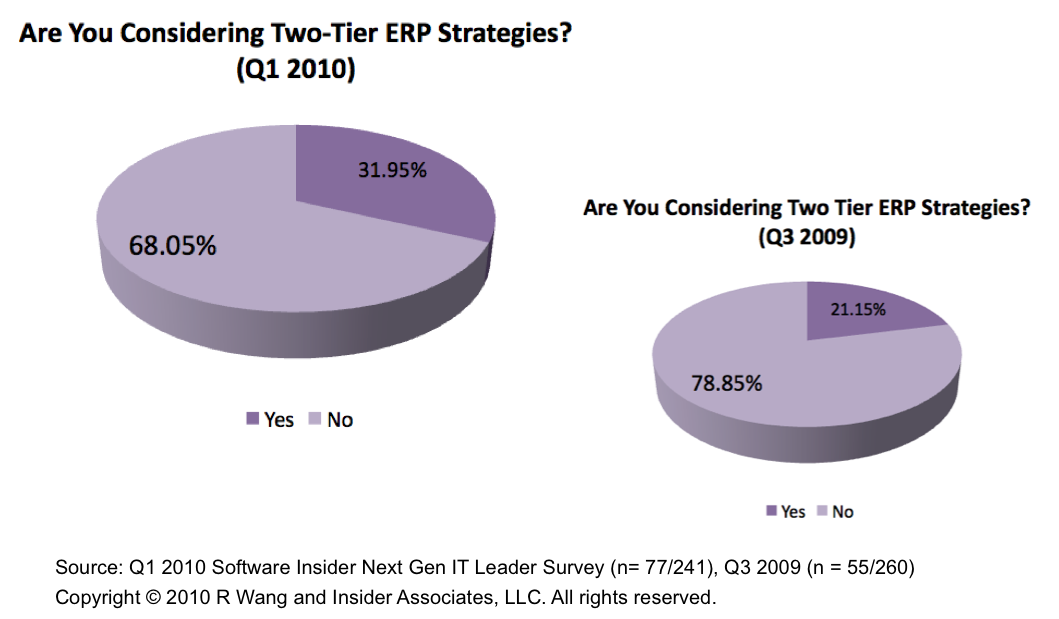

Recent Software Insider data surveys of next gen IT leaders in Q3 2009 and Q1 2010 show a 10% increase among organizations considering a Two-Tier ERP apps strategy (see Figure 1). Key drivers behind moving to a Two-Tier ERP approach stem from:

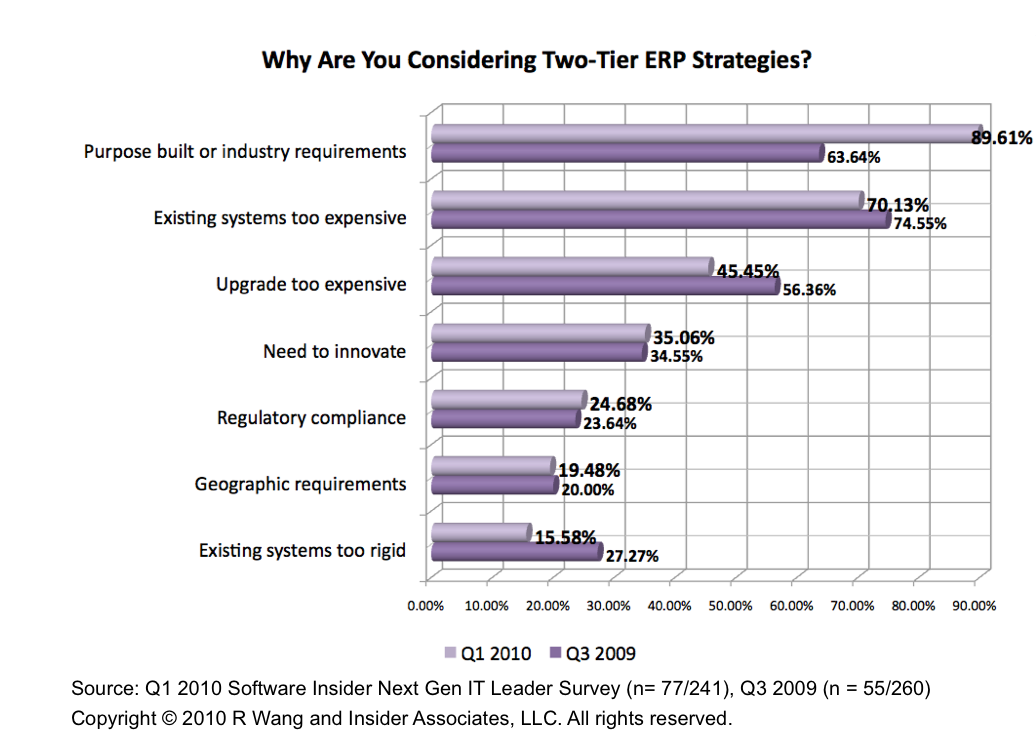

- Purpose built or industry requirements (89.61%). Next gen IT leaders remain frustrated by the lack of innovation and progress in completing out promised functional footprints. As market competition intensifies, industry specific, purpose built solutions provide the competitive advantage needed for survival and success.

- Existing systems too expensive (70.13%). ROI calculations on existing ERP systems often show high cost factors. The culprits - overruns in implementation, customization of reports, maintenance payments on shelfware, increasing costs to staff, and rigidity of system.

- Upgrade too expensive (45.45%). Many customers face upgrade costs equivalent to reimplementation. Cost factors could equal up to 85% of the original implementation cost.

- Need to innovate (35.06%). Some organizations find that their vendors have not innovated fast enough. Social channels have not been accounted for. User experiences seem dated. Reporting and analytics require experts to deliver. Paucity in mobile solutions hinder productivity.

- Regulatory compliance (24.68%). The need to meet industry specific regulatory compliance drive organizations to choose purpose built solutions. Many choose SaaS to mitigate the costs of legislative and regulatory updates.

- Geographic requirements (19.48%). Country or region specific requirements may require two-tier strategies based on geography. Some ERP systems lack the language or tax requirements and a separate instance will prove cheaper to run than customizing a monolithic large ERP solution.

- Existing systems too rigid (15.58%). Rigidity may lead to the inability to integrate and work with other systems, new channels, and emerging stakeholders. Integration solutions can assist, but long term, next gen IT leaders will begin to surround legacy solutions with newer technologies.

Figure 1. Two Tier ERP Strategies Gain Favor In Next Gen IT Leader Apps Strategies

Figure 2. Industry Requirements And Cost Drive Push To Two-Tier Apps Strategies

The Bottom Line - Users Should Consider Scenarios Based On Business Models And Geographic Needs

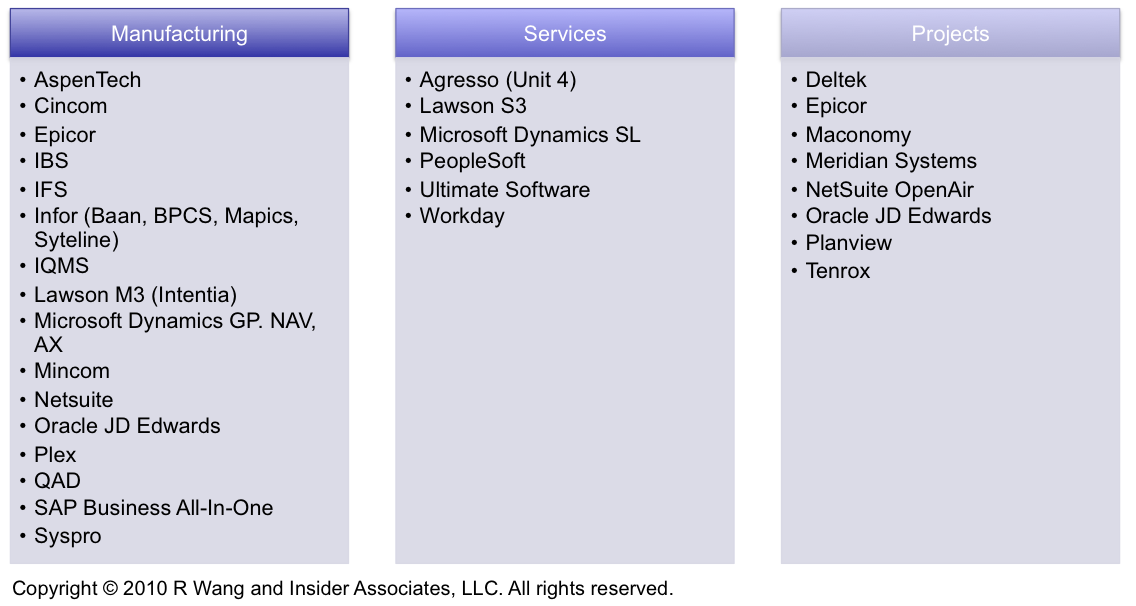

Detailed apps strategy conversations highlight 3 scenarios where Two-Tier ERP strategies make sense. A number of vendors have proven to be strong partners in enabling Two-Tier ERP (see Figure 3).

- Different business models. Organizations with very different lines of businesses often consider hub and spoke implementations. The drive to standardize on a single ERP system makes little sense when one subsidiary delivers services and the other manufactures goods. Several large multi-national conglomerates leverage more than two-tiers of ERP to handle a warranty business, financial services, and power generation manufacturing.

- Country specific deployments. Deploying a full scale ERP solution makes little sense for new subsidiaries when options exist at lower operating costs and higher ROI. One large Japanese manufacturer found cost savings with local based systems in North America and EMEA.

- Phased modernization efforts. Organizations looking to upgrade and modernize their systems may keep some legacy systems in place as they upgrade to more modern systems. One large entertainment concern has kept their financials systems and updated their retail systems with a more modern, web services based, SOA architected product.

Figure 3. Vendors To Watch In Two-Tier ERP Apps Strategies

Have you deployed a Two-Tier ERP strategy? How has it gone? What's worked? What's not? You can post or send on to rwang0 at gmail dot com or r at softwaresinsider dot org and we’ll keep your anonymity.

Please let us know if you need help with your enterprise apps strategy by:

- Developing your enterprise apps strategy?

- Addressing disruptive technologies like Social CRM, Cloud Computing, SaaS deployment, and Two-Tier ERP?

- Assessing the ROI of a Two-Tier ERP strategy?

* Not responsible for any factual errors or omissions. However, happy to correct any errors upon email receipt.

Copyright © 2010 R Wang and Insider Associates, LLC. All rights reserved.

Related Resources

20091203 Strategy: 5 Lessons Learned From A Decade Of Naught

20091222 Tuesday's Tip: 10 Cloud And SaaS Apps Strategies For 2010

20091208 Tuesday's Tip: 2010 Apps Strategies Should Start With Business Value

20091102 Best Practices: Lessons Learned In What SMB's Want From Their ERP Provider

20091006 Tuesday's Tip: Why Free Software Ain't Really Free

R "Ray" Wang

R "Ray" Wang R "Ray" Wang

R "Ray" Wang