Monday's Musings: Why Users Must Preserve Their Third Party Maintenance Rights

Apps Users Seek Third Party Maintenance For Cost, Value, and Service

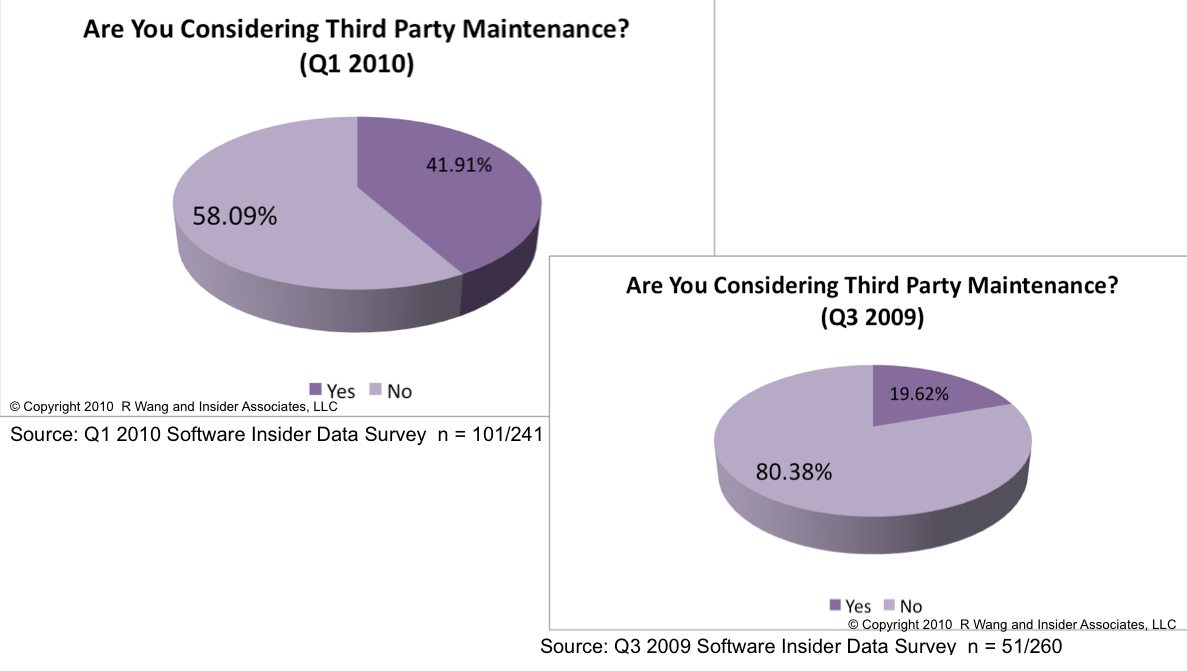

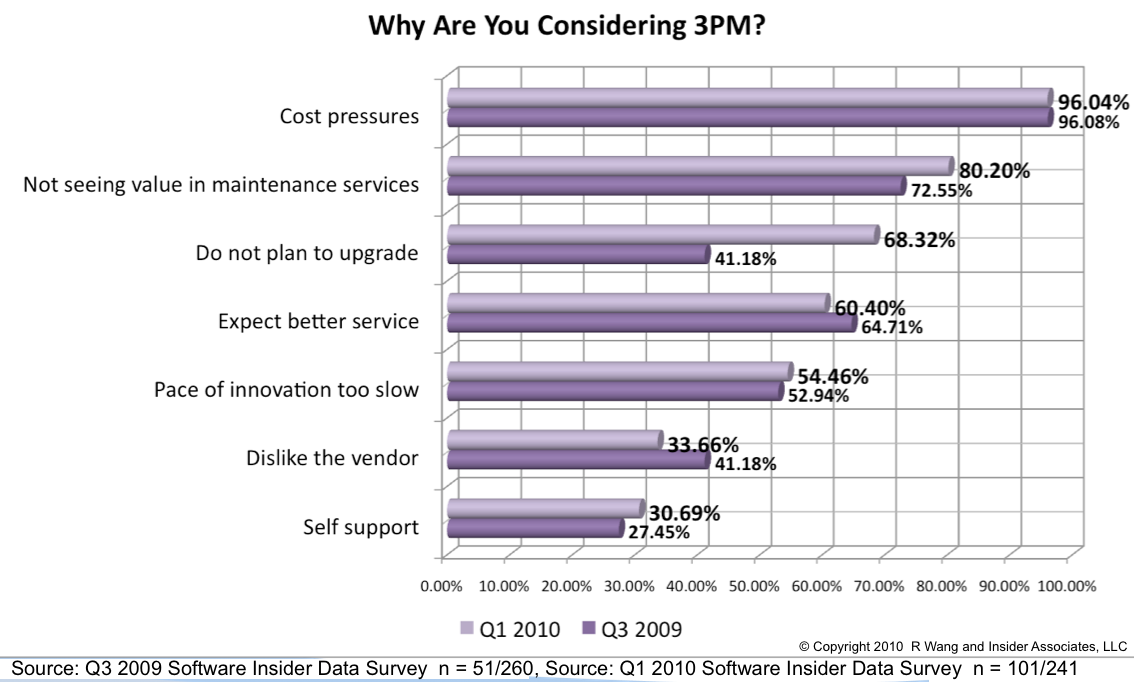

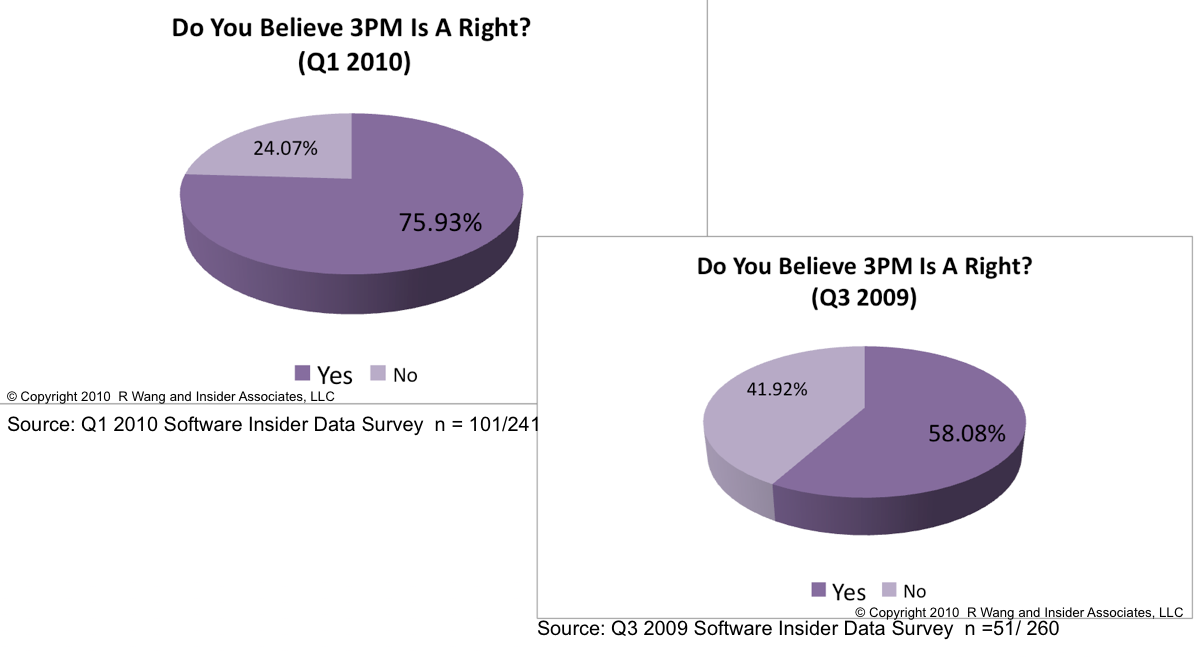

Updated surveys from inquiries, client conversations, and user group meetings show a 113.8% increase in interest in third party maintenance (3PM) services from Q3 2009 to Q1 2010 (see Figure 1). Key factors stem from (see Figure 2.):

- Continuing cost pressures. Budgets continue to be at flat or have been reduced. Organizations must do more with less. Add pressures to innovate, CIO's must find fat without trimming bone.

- Gaining minimal value in maintenance services. Most felt they were paying too much for too little. An 8 point jump reemphasized the issue with a lack of tiered offerings.

- Declining plans to upgrade. Worsening economic conditions from Q3 2009 to Q1 2010 led a 27 point increase in interest in 3PM. Expect many respondents to change their point of view (POV) as economic conditions improve.

- Expecting better service. Service continues to play a key factor in decisions to go to 3PM. Over 60% of respondents had experienced poor levels of service.

- Slowing pace of vendor innovation. Greater than half of respondents believe their vendor has been too slow to deliver new capabilities. These include SaaS deployment options or key functionality in areas such as strategic HCM and social CRM.

- Disliking the vendor. About 1/3 of the survey respondents have bad experiences with their vendor. Many times it comes from sales person or support rep experiences.

- Delivering self support. Almost 30% of respondents already provide their own support. These organizations have no need to pay maintenance when they are doing all the work.

Figure 1. Interest in 3PM grows 113.8% over 2 quarters.

Figure 2. Cost Pressures, Value, And Decision Not To Upgrade Drive Current Trends to 3PM

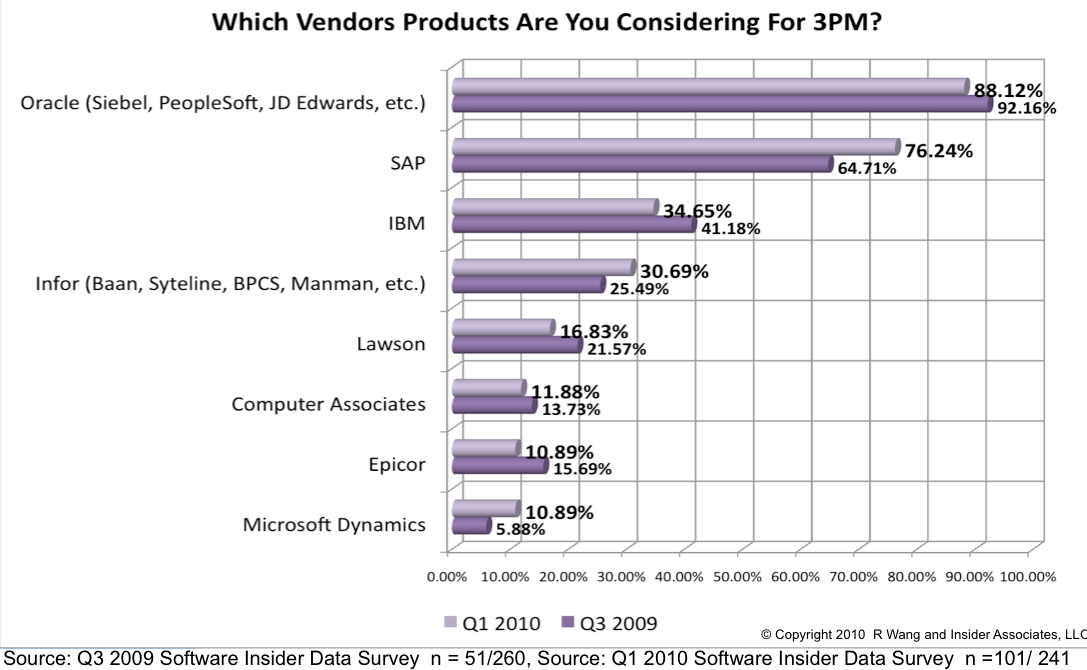

Limited Options Exist For Most Enterprise Apps Customers

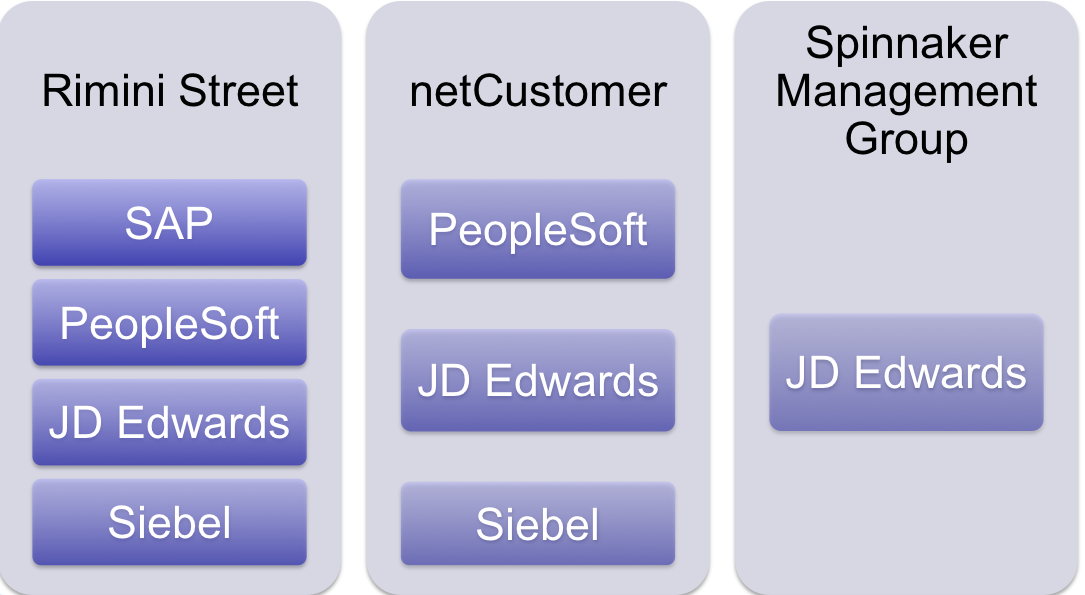

Of the 101 respondents in Q1 2010 interested in 3PM, Oracle (88.1%) and SAP (76.2%) users expressed the greatest interest in seeking independent services (see Figure 3). Over 80% of the users were from large companies greater than 1000 employees across the globe. Most SAP users surveyed have mixed environments with Siebel, JD Edwards, and PeopleSoft joint installations. Unfortunately, very few public options exist for sole SAP users (see Figure 4). For example, SAP customers can only turn to Rimini Street. Oracle customers on PeopleSoft, JD Edwards, and Siebel also have limited choices with Rimini Street, netCustomer, and Spinnaker among the options. IBM, Infor, Lawson, Computer Associates, Epicor, Microsoft Dynamics, Oracle E-Business Suite and database customers have no options. (Note: This data may not be completely statistically significant given the sample size of 240, but hopefully it provides some directional input.)

Figure 3. Oracle And SAP Users Drive Interest In 3PM

Figure 4. Very Few Public Options Exist For Customers

The Bottom Line For Users - Users And User Groups Must Band Together To Guarantee 3PM Rights. Don't Take These For Granted!

Although the latest surveys show a 17 point increase in the belief that 3PM is a right, this right is under fire by big vendors such as Oracle who have taken legal actions against 3PM providers for improperly (i.e. TomorrowNow) and allegedly (i.e. Rimini Street) violating intellectual property rights. If providers have violated such laws, Oracle rightfully should defend its positions and those providers be punished. However, there's a lot of money at stake. For most vendors, maintenance represents 50% to 80% of their revenue stream. Consequently, users and user groups have a responsibility to:

- Demand that their contracts include provisions that protect their right to 3PM

- Require vendors to work out rules on how 3PM providers can deliver services without violating software IP provisions

- Seek anti-trust class action with the US DOJ (i.e. Christine A. Varney) and the EU Compeition (i.e. Joaquín Almunia) against software vendors who hinder 3PM providers from providing services

Users and user groups must vigorously defend their positions in contracts and legal action or lose this right. Failure will result in a continued software maintenance monopoly. Success will ensure market competition and renewed innovation. Attention: OAUG, Quest, and SUGEN leadership your members need your help!

Figure 5. A Growing Body Of Users Believe 3PM Is A Right

The Bottom Line For Vendors - Proactively Address The Issue Or Expect A Groundswell Of Activism

SaaS, subscription pricing, 3PM, and the economy provide a confluence of forces that will continue to attack maintenance revenue streams. Many legal cases have been fought over this issue including IBM vs Amdahl and Geac vs Grace Consulting. SAP's failed attempt to convince customers on the value of Enterprise Support led to a public relations disaster and a factor in the resignation of their CEO. The result - many vendors considering price hikes held back. In fact, some savvy software vendors retooled and restored the client -vendor relationship by:

- Offering more entry points and tiers to support options. The three pillars of software maintenance and support policies still apply. However, several vendors are now offering more tiers of support as lower entry points. Two vendors have finalized plans to offer just the bare bones legal and regulatory updates. Other vendors have made it easier to come back with maintenance amnesty plans.

- Providing flexible maintenance policies. Vendors who change rigid policies have experienced success among customers. Some Both Infor through Infor Flex and Micrsoft Dynamics allow like for like swap credits to migrate between existing products.

- Renegotiating existing terms. Some vendors are helping clients meet the realities of the current market conditions. Big on the list is helping clients address shelf ware without repricing of contracts. For clients who paid full maintenance on software that’s at least 4 years old, some vendors are offering to reduce up to 20% of the overall licenses not in use. This leads to lower maintenance revenue but engenders good will among key clients. Further, several vendors have allowed clients to apply credit towards another module as an alternative.

- Delivering amnesty programs. Several vendors have allowed customers to return to maintenance programs after years of not paying. Such programs play a key role in helping customers upgrade but should be used sparingly as customers may become accustomed to this practice.

- Creating better peer forums to share information. Almost every vendor surveyed has a program to improve the online support capabilities. Applying Social CRM use cases, user generated content in peer forums tops the list of initiatives. Other plans focus on sharing data on benchmarks, operational metrics, and best practices.

- Assisting with vendor financing. Clients seek access to financing, especially many in the mid-market who’s credit lines have been zapped. Microsoft has led the charge by providing 0% financing for its Microsoft Dynamics ERP and Microsoft Dynamics CRM Customers. Other vendors such as IBM, Infor, Oracle, SAP, Sage also offer vendor led financing programs that include hardware, implementation, training, and other services.

- Lowering cost of usage and ownership. Though tops on the list as a conceptual practice, most vendors will need to roll out such initiatives over the next 24 months. A few notable exceptions include Agresso with its VITA architecture which allows customers to rapidly make business and UI changes, Microsoft Dynamics customers who report back significantly lowered implementation and training costs compared to most vendors, and Epicor customers who report significant productivity gains with Service Connect. SaaS customers already experience such gains.

Your POV

Take the new and improved survey on 3rd party maintenance and let us know if you need help with your enterprise apps strategy by:

- Conducting an ROI on 3rd party maintenance options

- Identifying cost reduction opportunities

- Renegotiating your software contracts

- Improving innovation via SaaS and other deployment options

Please post or send on to rwang0 at gmail dot com or r at softwaresinsider dot org and we’ll keep your anonymity.

Related resources and links

20091008 Deal Architect - Vinnie Mirchandani "Third Party Maintenance Is Really 4 Decades Old"

20071120 News Analysis: Too Early to Call the Death of Third Party Maintenance

20090210 Tuesday's Tip: Software Licensing and Pricing - Do Not Give Away Your Third Party Maintenance And Access Rights

20090709 Tuesday's Tip: Do Not Bundle Your Support and Maintenance Contracts!

20090622 News Analysis: Infor Flex Reflects Proactive Maintenance Policy

20090516 News Analysis: Rimini Street Launches Third Party Maintenance for SAP

20090504 News Analysis: Oracle Waives Fees On Extended Support Offerings

20080909 Trends: What Customers Want From Maintenance And Support

20080215 Software Licensing and Pricing: Stop the Anti-Competitive Maintenance Fee Madness

20090428 News Analysis: SAP and SUGEN Make Progress on Enterprise Support

20090405 Monday's Musings: Total Account Value, True Cost of Ownership, And Software Vendor Business Models

20090330 Monday's Musings: It's The Relationship, Stupid! (Part 2) - Stop Slashing The Quality Of Support And Maintenance

20090324 Tuesday's Tips: Five Simple Steps To Reduce Your Software Maintenance Costs

20090223 Monday's Musings: Five Programs Some Vendors Have Implemented To Help Clients In An Economic Recession

20081012 Monday's Musings: 5 Steps to Restoring Trust in the Vendor - Customer Relationship

20100114 News Analysis: SAP Revives Two Tier Maintenance Options

20091012 Research Report: Customer Bill of Rights - Software-as-a Service

20090912 News Analysis: Siemens Cancels SAP Maintenance Contract

20090910 Tuesday's Tip: Note To Self - Start Renegotiating Your Q4 Software Maintenance Contracts Now!

20090602 Tuesday’s Tip: Now’s The Time To Consider SaaS Software Escrows

Copyright © 2010 R Wang and Insider Associates, LLC. All rights reserved.

R "Ray" Wang

R "Ray" Wang R "Ray" Wang

R "Ray" Wang