Tuesday's Tip: Dealing With Vendor Threats To Charge For Back Maintenance Fees

Four Common Customer Scenarios Will Trigger Vendors To Raise The Back Maintenance Fee Discussion

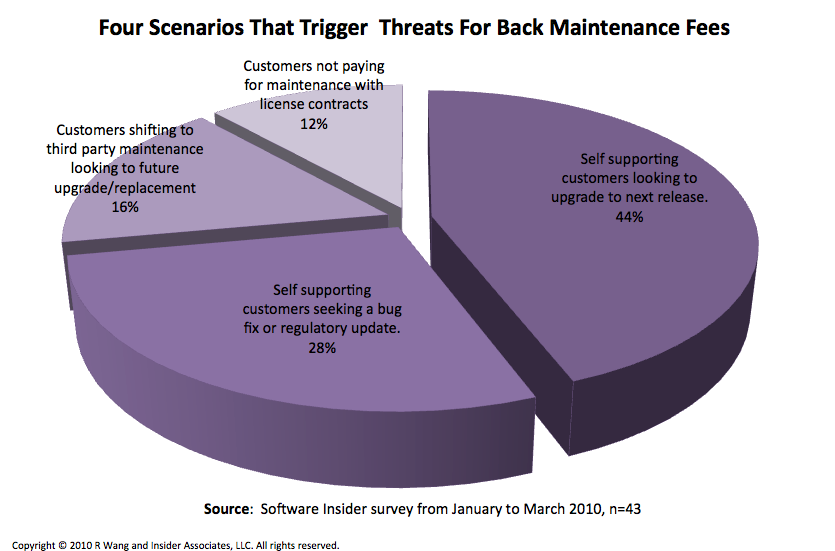

Back maintenance fees describe the amount an organization would have paid for maintenance if they would have continued to pay the usual stream required to access support, bug fixes, patches, and upgrade rights. As economic conditions have worsened, many organizations have turned to self-support, third party maintenance (3PM), or dropped support. Discussions with 43 enterprise software customers reveal four common scenarios (see Figure 1):

- Scenario 1: Self supporting customers looking to upgrade to next release. Customers (44.19% n=19/43) in these scenarios typically run mature systems and are in businesses that do not face dynamic change . They stopped paying maintenance years ago and rarely make major changes to the system.

Catalyst: Something happens in the business and the need to upgrade arises.

Typical vendor response: Upgrades can only be provided to customers who pay for maintenance. Upon payment of back maintenance, upgrades will be provided. In some cases, vendors also levies a penalty. - Scenario 2: Self supporting customers seeking a major bug fix or regulatory update. Organizations (27.91% n=12/43) in this dynamic have self-supported for years without incident but run into scenarios where their own teams can not resolve an issue.

Catalyst: Bug fixes and major regulatory changes can not be supported by the internal team.

Typical vendor response: Bug fixes and regulatory updates can only be provided to customers who pay for maintenance. Upon payment of back maintenance, patches and regulatory updates will be provided. In some cases, vendor also levies a penalty. - Scenario 3: Customers shifting to third party maintenance (3PM) looking to future upgrade/replacement. Those customers (16.28% n=7/43) who move to a third party maintenance provider and give up future upgrade rights often face threats from sales people that they will have to "pay dearly" if they plan to come back to the vendor.

Catalyst: Final decision to end of life systems and upgrade to new platform results in interaction with existing vendor.

Typical vendor response: Customer must pay back maintenance in order to purchase additional modules or upgrade. In some cases, vendor also levies a penalty. - Scenario 4: Customers not paying for maintenance with license contracts. More and more customers (11.63% n = 5/43) in newer areas such as CRM no longer pay for maintenance and support past the first year. With replacements every 4 to 5 years for CRM, some customers achieve a better ROI by avoiding the 5 years of maintenance. Why? Five years of maintenance at 20% is equivalent to the cost of the original license. Instead, they just rebuy a replacement/upgrade every 5 years.

Catalyst: Replacement and full rebuy of new system.

Typical vendor response: Customer must pay back maintenance in order to purchase additional modules or upgrade. In some cases, vendor also levies a penalty.

Figure 1. Common Triggers That Drive Back Maintenance Fee Threats

Customers Often Have More Leverage Than They Realize

Most organizations fear that vendors will carry out threats to charge back maintenance. Those vendors who subsidize license fees with maintenance to maximize Total Account Value (TAV) often threaten customers the most. Many organizations will cave-in to demands. Do not cave-in! In almost every scenario, expert contract negotiations often result in win-win propositions for both the customer and the vendor for a few reasons:

- Vendors really don't want to lose an existing customer. Despite the threats from vendors, customers who self support, move to third party maintenance (3PM), or opt out of support, find themselves with significant leverage. Free of the vendor, organizations in this scenario can make a clean decision because the technology typically is outdated, the cost of upgrade is close to the cost of reimplementation, and the organization has entered a new buying cycle. If a current vendor wants a customer to pay back maintenance on top of the new license fees, that vendor will find themselves at a price disadvantage with a newer alternative. Most vendors would rather win your business than lose a customer over back maintenance fees.

- SaaS competition brings more choices in most categories. The explosion of SaaS deployment options opens up the door to competition with the traditional on-premise vendors. In most cases, there are enough viable options to add competitive pressures. SaaS competitors can transcend existing platforms allowing for more choice in new markets. Organizations should introduce SaaS vendors into short lists in decisions to replace or add additional functionality to existing systems. Competition often results in the vendor backing down on their back maintenance fee threat.

- Most customers have not bundled their service contracts. With a flurry of mergers and acquisitions for organizations and the technology vendors, most organizations have not consolidated their software contracts. Separate agreements give organizations significant leverage when dealing with vendors because organizations can choose which applications and solutions to cut maintenance on. This power to slice and dice among the contracts provides tremendous negotiation advantage and a strong check and balance with vendors. Do not bundle your maintenance contracts unless significant advantages exist in new terms and conditions.

The Bottom Line For Users - Software Market Remains A Competitive Buyers Market For Now

Economic conditions, SaaS competition, and heavy dependence on maintenance revenue leave software vendors hungry and competitive for new license revenue. In markets with SaaS competition, customers continue to win concessions in license and maintenance fee reductions. Today, few vendors can afford to enforce their threats to charge for back maintenance. With a high likelihood that current conditions will continue, its would be unlikely to assume that vendors would give up the opportunity to win license revenue by charging for back maintenance. Work with a contract negotiations expert with applications strategy experience for the best results. Avoid contract negotiators who do not understand vendor product road maps or hide behind revenue recognition excuses.

Your POV

Has your vendor threatened back maintenance? Should you have rights to Third Party Maintenance (3PM) ? Do you feel its okay for your vendor to prevent you from access? What's a fair amount to pay for maintenance? Add your comments to the discussion or send on to rwang0 at gmail dot com or r at softwaresinsider dot org and we’ll keep your anonymity.

Please let us know if you need help with your contract negotiations and maintenance renegotiation. Here’s how we can help:

- Assistance with vendor threats of back maintenance

- Crafting your next gen apps strategy

- Contract negotiations support

- Free market evaluation to identify contract cost savings

Related resources and links

Take the new and improved survey on 3rd party maintenance

20100222 Monday's Musings: Why Users Should Preserve Their Third Party Maintenance Rights

20091008 Deal Architect - Vinnie Mirchandani “Third Party Maintenance Is Really 4 Decades Old”

20071120 News Analysis: Too Early to Call the Death of Third Party Maintenance

20090210 Tuesday’s Tip: Software Licensing and Pricing - Do Not Give Away Your Third Party Maintenance And Access Rights

20090709 Tuesday’s Tip: Do Not Bundle Your Support and Maintenance Contracts!

20090622 News Analysis: Infor Flex Reflects Proactive Maintenance Policy

20090516 News Analysis: Rimini Street Launches Third Party Maintenance for SAP

20090504 News Analysis: Oracle Waives Fees On Extended Support Offerings

20080909 Trends: What Customers Want From Maintenance And Support

20080215 Software Licensing and Pricing: Stop the Anti-Competitive Maintenance Fee Madness

20090428 News Analysis: SAP and SUGEN Make Progress on Enterprise Support

20090405 Monday’s Musings: Total Account Value, True Cost of Ownership, And Software Vendor Business Models

20090330 Monday’s Musings: It’s The Relationship, Stupid! (Part 2) - Stop Slashing The Quality Of Support And Maintenance

20090324 Tuesday’s Tips: Five Simple Steps To Reduce Your Software Maintenance Costs

20090223 Monday’s Musings: Five Programs Some Vendors Have Implemented To Help Clients In An Economic Recession

20081012 Monday’s Musings: 5 Steps to Restoring Trust in the Vendor - Customer Relationship

20091012 Research Report: Customer Bill of Rights - Software-as-a Service

20090912 News Analysis: Siemens Cancels SAP Maintenance Contract

20090910 Tuesday’s Tip: Note To Self - Start Renegotiating Your Q4 Software Maintenance Contracts Now!

Copyright © 2010 R Wang and Insider Associates, LLC. All rights reserved.

R "Ray" Wang

R "Ray" Wang R "Ray" Wang

R "Ray" Wang