Tuesday's Tip: 10 SaaS/Cloud Strategies For Legacy Apps Environments

Legacy Apps Customers Seek Practical Advice

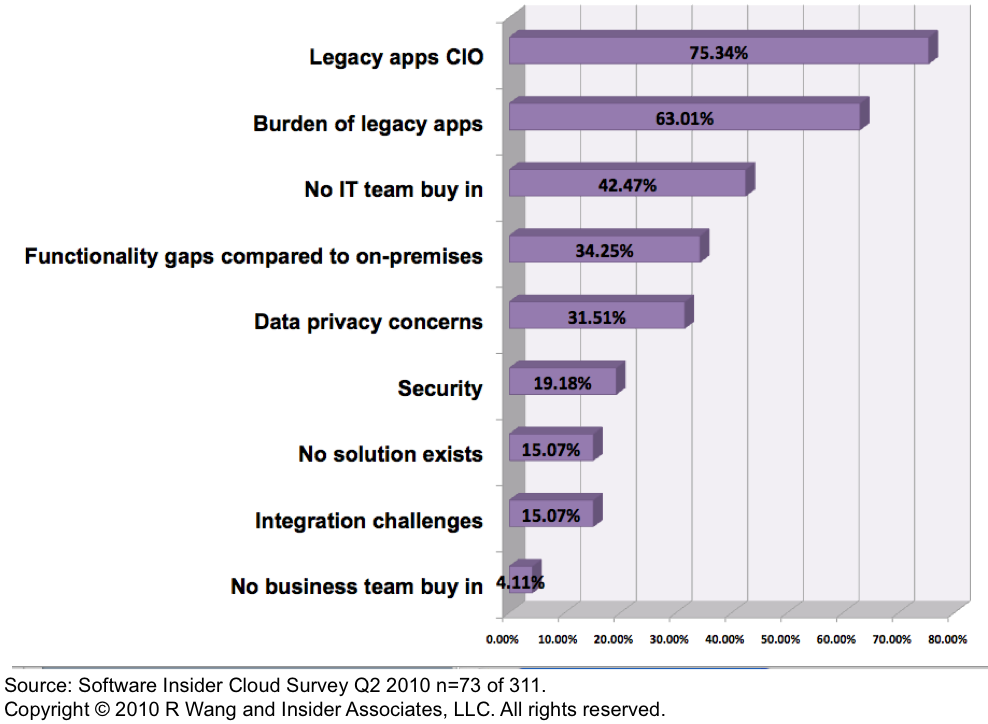

Organizations determining when and how to make the move to SaaS and Cloud face realistic challenges in gaining buy-in and realizing the apparent and hidden benefits of SaaS/Cloud. In a recent survey of over 300 companies, 73 respondents who were wary of SaaS/Cloud were asked to list the top 3 reasons they did not plan to deploy a SaaS/Cloud solution in the next 12 months (see Figure 1). The top 3 reasons related to legacy environments, org structure, and governance include:

- Legacy apps CIO's. CIO's vested in protecting the existing investments may often proceed with caution for SaaS and Cloud solutions. In some cases, sunk cost mentality takes hold and the goal of being 100% pure with a single vendor clouds the vision to meet needed business requirements.

- Burden of legacy apps. Legacy apps maintenance and upkeep represents a key barrier to SaaS and Cloud adoption. Organizations often remain complacent about maintenance and upgrades, preferring to avoid substantial changes and risk. Becuase the money and resources to support legacy apps consume most of the budget, organizations have little funds for innovation and experimentation. Eventually, business decision makers procure SaaS/Cloud solutions to by-pass IT.

- No IT team buy in. Many constrained IT teams have not taken the time to understand the requirements to support SaaS and Cloud apps in a hybrid mode. SaaS requires organizations to revisit SOA strategies, integration requirements, and master data management. Business leaders and decision makers often overlook these dependencies at the organization's long term expense.

Figure 1. Legacy Issues Hamper SaaS/Cloud Adoption

SaaS/Cloud Strategies Must Transcend The Burden Of Legacy Apps Over Time

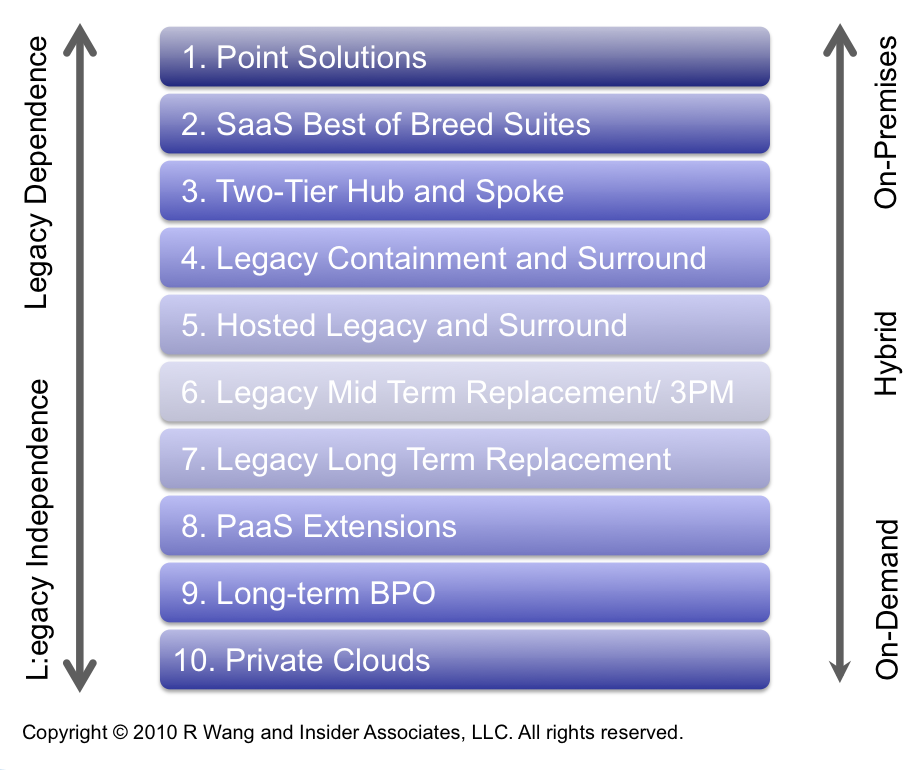

Next generation apps strategies must account for both a future of hybrid deployments and growing independence of legacy apps. Ten of the most common go forward strategies include:

- Point solutions. Organizations often start by augmenting gaps in existing legacy apps functionality. Common areas include expense management, strategic human capital management (HCM), sales force automation, project based solutions, collaboration, and email.

- SaaS best of breed suites. As organizations gain comfort with the ease of use of SaaS, expect organizations to increase their preference for suites. Over time expect the best of breed "hell" scenarios to subside as SaaS vendors and integration providers rush to provide more end to end functionality or better SaaS to SaaS integration tools.

- Two-tier hub and spoke. Once organizations make the plunge to SaaS, the business will seek opportunities to bypass legacy apps in new environments. Two-tier deployments will emerge as organizations rush to replace legacy apps for modernization efforts, geographic considerations, and organizations with different sets of business models.

- Legacy containment and surround. As with legacy apps over time, organizations will seek to contain investment and surround existing apps with new capabilities. Expect core ERP apps in finance and HCM to be contained but not quickly replaced. However, failed CRM, project based solutions, and other "extended ERP" systems in vendor suites will be replaced because many vendors have not innovated quickly enough.

- Hosted legacy and surround. Hosted legacy and surround will emerge as a critical trend that will cut infrastructure costs for data centers and hardware. Virtualization will play a key role in reducing application management costs. Once again, the surround strategy will take hold because business can not wait for innovation from many of the legacy apps vendors.

- Legacy mid-term replacement and third-party maintenance. Organizations can fund innovation with maintenance fee reductions by considering third party maintenance (3PM). Typical deals halve the cost of maintenance while providing regulatory and tax updates. Upgrades will not be provided but for organization's who plan to replace apps in the next 5 years, this option should be considered in all apps strategies.

- Legacy long term replacement. After usage of 10 to 15 years, most organizations begin their retirement and replacement strategies. Given the increasing choices in SaaS and Cloud, expect organizations to make the move to migrate to a more flexible solution.

- PaaS extensions. As packaged apps move to the Cloud, custom development will also make the same transition. PaaS will prove to be a key component in the Cloud strategy and major SaaS vendors will make the move to open up the tool kits to allow customers and partners to extend their solutions.

- Long term BPO. Expect commoditized business processes to shift to the BPO model. BPO - SaaS will become the norm as organizations shed lower level processes and focus on custom dev in PaaS and extending SaaS and Cloud suites.

- Private clouds. Many organizations will move to private clouds for security reasons. Private clouds will serve as both a development environment and the "back-up" generator for large commercial and public entities.

Figure 2. Ten SaaS/Cloud Adoption Strategies Span Business Requirements And Legacy Adoption

The Bottom Line For Buyers (Users) - Proceed With Cloud/SaaS Strategies Based On Business Requirements Not Hype

While Cloud/SaaS adoption has moved beyond the tipping point, organizations should not rush in without an adequate apps strategy. Start by taking into consideration the following criteria in planning an overall apps strategy:

- Expected business value and outcomes for a project

- Business processes required to support business value and outcomes

- Organizational design required to sustain change

- Technology and solutions to support efforts

- Deployment options such as on-premises, SaaS, BPO, and other services

Your POV.

Have you already made the transition? Ready to share your best practices? Buyers, do you need help with your Cloud and SaaS strategy? Looking to make the transition to Cloud and SaaS? Let us put the expertise of over 1000 software contract negotiations to work for you. Please post or send on to rwang0 at gmail dot com or r at softwaresinsider dot org and we’ll keep your anonymity.

Please let us know if you need help with your next gen apps strategy, overall apps strategy, and contract negotiations projects. Here’s how we can help:

- Designing a next gen apps strategy

- Providing contract negotiations and software licensing support

- Demystifying software licensing

- Assessing SaaS and cloud

- Evaluating Cloud integration strategies

- Assisting with legacy ERP migration

- Planning upgrades and migration

- Performing vendor selection

- Renegotiating maintenance

Resources And Related Research:

20100621 A Software Insider's POV - R "Ray" Wang - "Research Report: How SaaS Adoption Trends Show New Shifts In Technology Purchasing Power"

20100322 A Software Insider’s POV – R “Ray” Wang -”Understanding The Many Flavors Of Cloud Computing/SaaS”

20091222 A Software Insider’s POV – R “Ray” Wang “Tuesday’s Tip: 10 Cloud And SaaS Apps Strategies For 2010″

20091208 A Software Insider’s POV – R “Ray” Wang – “Tuesday’s Tip: 2010 Apps Strategies Should Start With Business Value”

20091012 A Software Insider’s POV – R “Ray” Wang – “Research Report: Customer Bill of Rights – Software-as-a Service”

20090714 Sandhill.com – R “Ray” Wang – “Opinion: Moving to a SaaS Offensive”

20090602 A Software Insider’s POV – R “Ray” Wang ” Tuesday’s Tip: Now’s The Time To Consider SaaS Software Escrows”

20081028 A Software Insider’s POV – R “Ray” Wang “Tuesday’s Tip: SaaS Integration Advice”

Reprints

Reprints can be purchased through the Software Insider brand or Altimeter Group. To request official reprints in PDF format, please contact [email protected].

Disclosure

Although we work closely with many mega software vendors, we want you to trust us. For the full disclosure policy please refer here.

Copyright © 2010 R Wang and Insider Associates, LLC. All rights reserved.

R "Ray" Wang

R "Ray" Wang R "Ray" Wang

R "Ray" Wang