Research Summary: Economic Trends Exacerbate Digital Business Disruption And Digital Transformation (The Futurist Framework Part 3)

Constellation Applies A Futurist Framework To Guide 2014 Outlook and Beyond

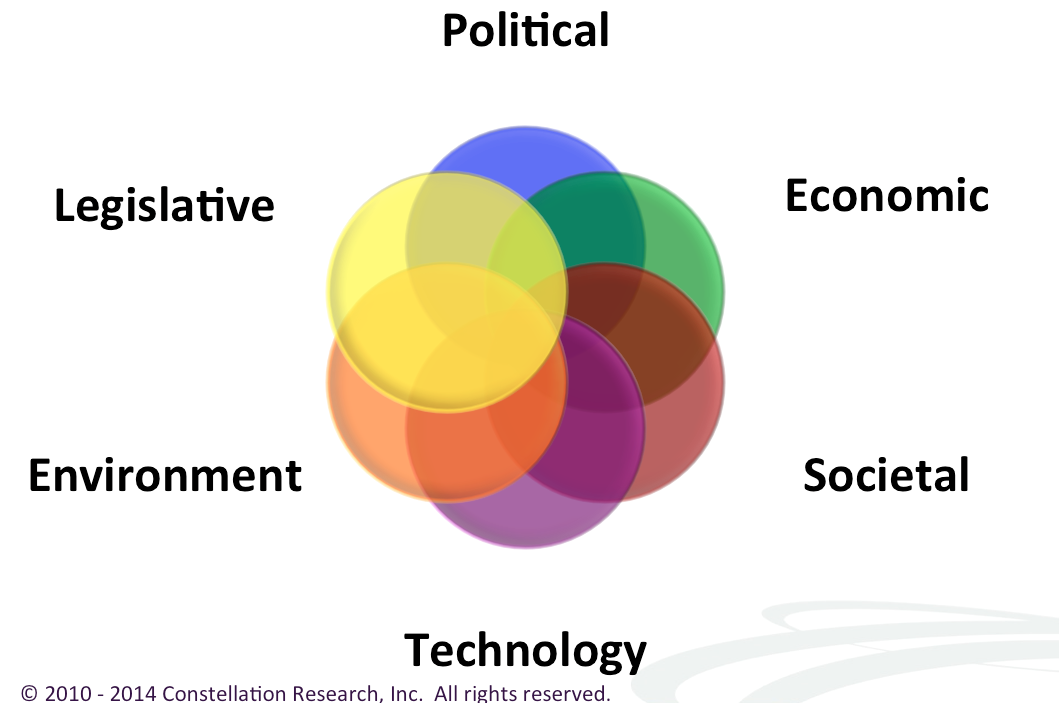

Constellation's research team uses a tried and true futurist framework that looks at the political, economic, societal, technological, environmental and legislative (PESTEL) shifts ahead (see Figure 1). The PESTEL model is used to synthesize the major trends and provides guidance on how Constellation approaches its seven key business themes over the next 2 to 3 years in:

- Consumerization of Technology and the New C-Suite

- Data to Decisions

- Digital Marketing Transformation

- Future of Work

- Matrix Commerce

- Next-Generation Customer Experience

- Technology Optimization and Innovation

The strategic assumptions from Constellation’s 2014 PESTEL framework form the basis for the business theme-led research. Over the next 36 months, research from each business theme will factor these trends into the overall research agenda. The goal in 2014 is to help clients not only navigate, but also dominate digital disruption.

In part 1, the focus was on the technological trends.

In part 2, the focus is on societal trends.

Download the report snapshot

See the February 27, 2014 webinar

Figure 1. PESTEL Approach Provides a Futurist Framework For Business Themes and Planning

Figure 1. PESTEL Approach Provides a Futurist Framework For Business Themes and Planning

Economic Trends Exacerbate Digital Business Disruption

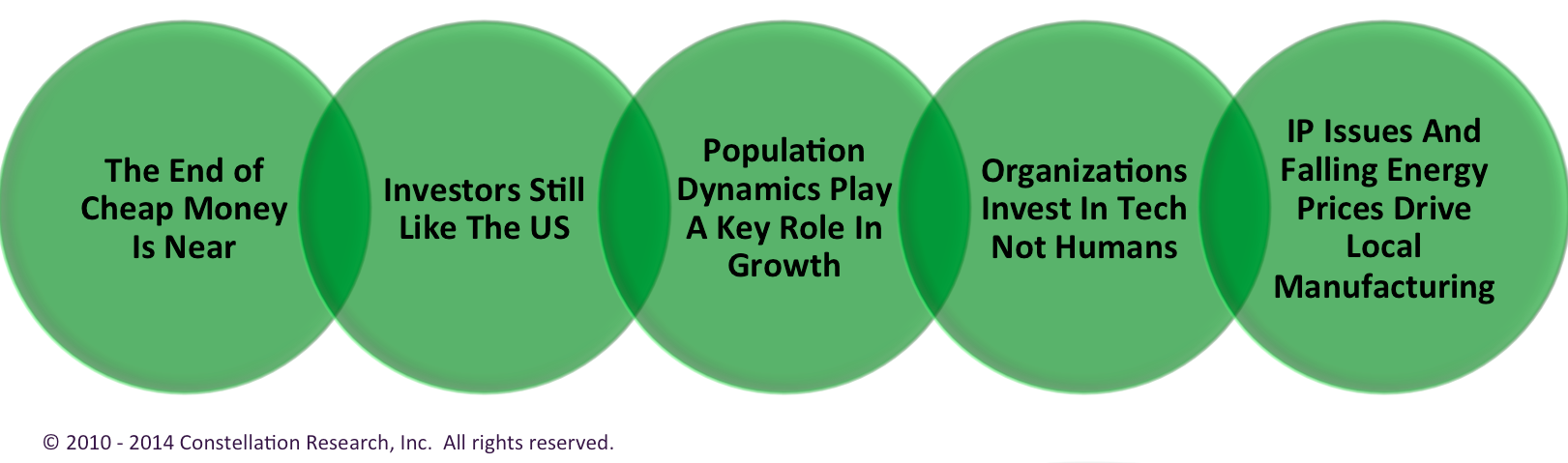

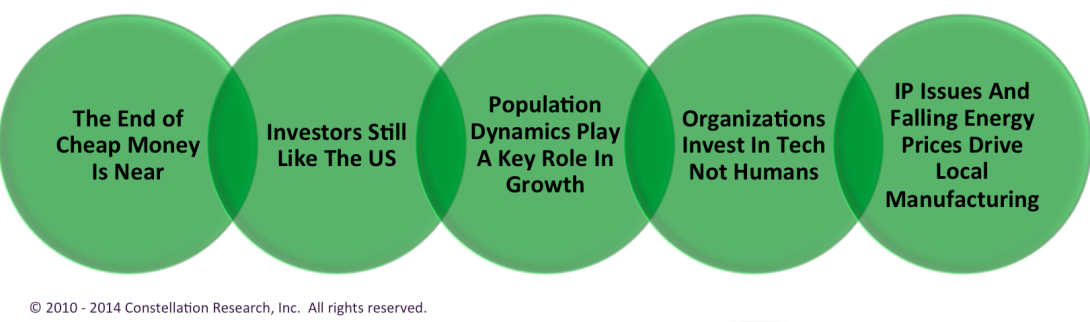

Still reeling from the impact of the global financial crisis of 2008, Western economies have printed their way out of shock by providing short-term liquidity. Of grave concern, inflation appears around the corner as high debt loads stunt growth. Meanwhile, China and the resource-rich regions such as Africa, the Middle East, Canada and Australia continue their export-led and infrastructure-fueled economic growth. Brazil, Russia, India and China (the BRICs) as well as South Africa continue to grow their economies through direct foreign investment while Malaysia, Indonesia, Nigeria and Turkey (the MINTs) emerge onto the global economic scene. Five economic trends shape the prioritization of investments in digital disruption (see Figure 2):

Figure 2. Economic Trends Exacerbate Digital Business Disruption

- The End of Cheap Money Is Near. An improving economic outlook leads to tightening of cheap money. Flush with money, central banks around the world must rein in the overall supply of money. The U.S. Federal Reserve will continue to slow down quantitative easing activities as economic indicators stabilize. Organizations will continue to borrow while they can as banks begin to raise the cost of capital. But investments will flow to digital business initiatives to help them achieve agility and scale.

- Investors Still Like The US. Investment in the United States remains attractive. Despite the 13 percent-plus massive growth of M2 money supply in China and the quantitative easing in the U.S., global investors continue to hedge home country investments by making real estate and other high value asset investments in U.S. dollars. Meanwhile, rising U.S. interest rates and the pullback from quantitative easing will result in declining investment in BRICs and MINTs as investors seek to capitalize on higher returns in the U.S.

- Population Dynamics Play A Key Role In Growth Strategies. Brands focus on rapidly growing markets in Brazil, China, Malaysia, Nigeria, India, Indonesia and Turkey. According to the International Monetary Fund, the size of emerging market economies surpassed more than half of the world's GDP in 2013. These markets represent the future of hyper economic growth and are a leading indicator for enterprise growth. Investment in Western economies and more developed economies will continue to remain from flat to up 7.8 percent.

- Organizations Invest In Tech Not Humans. Cost of human-based employment drives a push to technology. Legislative and regulatory burdens on employment lead to increasing investment in technology to automate or eliminate the human factor. A November 2013 poll from The Wall Street Journal’s Real Time Economics blog showed that 86 percent of organizations did not intend to hire in 2014. Hiring will be limited to the highly skilled and extremely talented. Budgets will prioritize human work that can be automated. Expect automation to go up the stack from manual labor to professional positions such as accountants, lawyers and physicians.

- IP Issues And Falling Energy Prices Drive Local Manufacturing. Manufacturing returns to being locally based. Lower energy costs, rising labor rates in previously “low cost” countries and worries about intellectual property drive nearshoring of manufacturing. In November 2013, the U.K. government’s Manufacturing Advisory Service estimated that 15 percent of companies had recently returned production to the United Kingdom versus 4 percent that planned to offshore. A Manpower Group survey in September 2013 also showed a return of U.S. manufacturing from China due to a closing wage gap and intellectual property concerns. Automation provides a key enabler in driving down labor rates and union requirements. Mass personalization at scale, the ability to create small production runs tailored to customer needs, reaches proper price points, enabling small scale manufacturing to return to home countries.

The Bottom Line: Economic Trends Alone Are Not Enough To Consider In Dominating Digital Disruption

The premise behind the Constellation Futurist Framework requires the broader perspective of five other areas: political, economic, societal, environment, and legislative. When taken in concert, boards, CEOs, management teams, and strategic advisors will have a set of trends that provide context to the digital disruption ahead. The framework is just the beginning. A successful strategy will build on this futurist framework to map out the next 24 to 36 months of business model disruption.

VIDEO: Webinar of the Constellation Outlook on Digital Disruption

Your POV.

Are you still seeing the world through the lens of Social, Mobile, Cloud, Analytics, and UC/Video? Does this help you take the bigger perspective? Ready for digital disruption? Add your comments to the blog or reach me via email: R (at) ConstellationR (dot) com or R (at) SoftwareInsider (dot) org.

- Developing your digital business strategy

- Connecting with other pioneers

- Sharing best practices

- Vendor selection

- Implementation partner selection

- Providing contract negotiations and software licensing support

- Demystifying software licensing

- Research Summary: Five Societal Shifts Showcase The Digital Divide Ahead (The Futurist Framework Part 2)

- Research Summary: Sneak Peaks From Constellation’s Futurist Framework And 2014 Outlook On Digital Disruption

- Research Report: Digital ARTISANs – The Seven Building Blocks Behind Building A Digital Business DNA

- Research Summary: Five Societal Shifts Showcase The Digital Divide Ahead (The Futurist Framework Part 2)

- Research Summary: Next Generation CIOs Aspire To Focus More On Innovation And The Chief Digital Officer Role

- Trends: [VIDEO] The Digital Business Disruption Ahead Preview – NASSCOM India Leadership Forum (#NASSCOM_ILF)

- News Analysis: New #IBMWatson Business Group Heralds The Commercialization Of Cognitive Computing. Ready For Augmented Humanity?

- Harvard Business Review: What a Big Data Business Model Looks Like

- Monday’s Musings: How The Five Consumer Tech Macro Pillars Influence Enterprise Software Innovation

- Tuesday’s Tip: Understand The Five Generation Of Digital Workers And Customers

- Monday’s Musings: The Chief Digital Officer In The Age Of Digital Business

- Slide Share: The CMO vs CIO – Pathways To Collaboration

- Event Report: CRM Evolution 2013 – Seven Trends In The Return To Digital Business And Customer Centricity

- News Analysis: Sitecore Acquires Commerce Server In Quest Towards Customer Experience Management

- News Analysis: Salesforce 1 Signals Support For Digital Business at #DF13

- Research Summary And Speaker Notes: The Identity Manifesto – Why Identity Is At The Heart of Digital Business

Reprints

Reprints can be purchased through Constellation Research, Inc. To request official reprints in PDF format, please contact Sales .

Disclosure

Although we work closely with many mega software vendors, we want you to trust us. For the full disclosure policy,stay tuned for the full client list on the Constellation Research website.

* Not responsible for any factual errors or omissions. However, happy to correct any errors upon email receipt.

Copyright © 2001 -2014 R Wang and Insider Associates, LLC All rights reserved.

Contact the Sales team to purchase this report on a a la carte basis or join the Constellation Customer Experience

R "Ray" Wang

R "Ray" Wang R "Ray" Wang

R "Ray" Wang