Tuesday's Tip: Seven Universal Factors Why Technology Firms Fail

Hubris Drives Most Tech Firm Failures

After observing the technology industry for two decades, one can't help but identify a recurring theme - the beginning of the end of a technology vendor. While most firms do not endure a mass failure and come back to life like Apple did with Steve Jobs or transform business models as IBM did under Lou Gerstner, Constellation often sees early signs when a technology vendor is in trouble. The factors that take shape often manifest for years but are apparent. While the tectonic shift of technology trends, business models, and non-traditional competitors play a key role, seven universal factors stem from hubris by management.

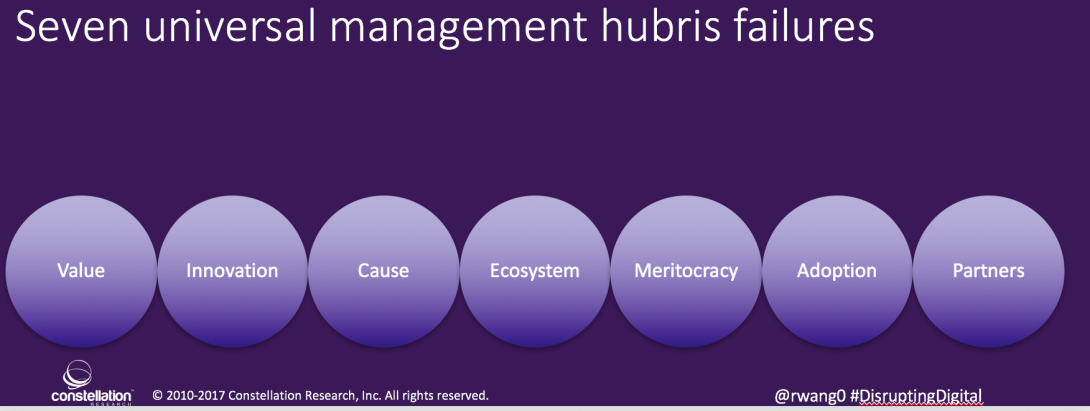

These seven universal VICEMAP failures include (see Figure 1):

- Value. Customers no longer perceive nor receive value for goods and services. ERP vendors in the late 1990's and early 2000's would buy each other up and hold customers hostage on maintenance without delivering new updates and key features. Reliance on marketing over product or service to cover up deficiencies is a common failure strategy.

- Innovation. Vendors who fail to move to new platforms, slow the pace and quality of innovation, or not adapt to new trends would fail to make the transition to the next era. In many cases, the pile of technical debt from failing to innovate holds back the vendor's ability to innovate. Slashing of R&D and innovation budgets, departure of key founders and executives, and the failure to attract new talent signify impending failure.

- Cause. Forgetting the mission of the vendor can quickly impact brand value and future direction. Searching for the "why" and a constant change of tag lines and logos is a telltale sign.

- Ecosystem. Under developing a community of customers and partners hinders growth and success. The vendor should find ways to reduce the friction in working with partners and to empower customers to become advocates.

- Meritocracy. Talent requires recognition of accomplishment and reward for outcomes. An over correctional shift to hiring for political correctness over talent and the failure to promote internal talent starts the decline.

- Adoption. One of the most significant factors to customer success is adoption. Hard to use products, failure to accommodate customer requests often lead to declining adoption and usage.

- Profitability. The shift from market share to profitability per sale is a requirement for success. However, a decreasing profit per sale means that competitors have more money to invest and innovate.

Figure 1. Seven Universal Management Hubris Failures (VICEMAP)

The Bottom Line: Failure Is Preventable

As a client advocate, the role of an industry analyst requires a critical evaluation of a technology vendor's viability. Viability rests on the management talent and life cycle of an organization. Early startups focus on attracting the right talent. Well funded startups focus on developing the right products. IPO'd companies focus on growing the customer market share. Legacy tech vendors focus on financial engineering. While each of these stages have different goals, the seven universal factors apply throughout the life cycle. In fact, failure in any two of these seven factors hint at decline. Failure in more than four factors highlight a severe risk. Failure in more than five hasten the decline to an irreversible recovery. This framework powers Constellation's view on how well a vendor will succeed and align with a buy-side client's overall technology and business strategy.

Your POV.

Have you evaluated your vendor's viability in your strategic plan? Do you have the right framework for analysis? Would you like to join a network of other early adopters? Are you in the midst of digital transformation and want to ensure you are working with the right vendors? Learn how non-digital organizations can disrupt digital businesses in the best-selling Harvard Business Review Press book Disrupting Digital.

Join like minded folks at the Constellation Executive Network.

Add your comments to the blog or reach me via email: R (at) ConstellationR (dot) com or R (at) SoftwareInsider (dot) org.

- Developing your digital business strategy

- Connecting with other pioneers

- Sharing best practices

- Vendor selection

- Implementation partner selection

- Providing contract negotiations and software licensing support

- Demystifying software licensing

Resources And Related Research

- Monday’s Musings: Dynamic Leadership – A Responsive And Responsible Approach #Davos17 #WEF

- News Analysis: In Search Of Growth Amidst Digital Disruption

- Event Report: The Weekend Before Davos And The Dawn Of The Fourth Industrial Revolution

- Event Report: The @Wipro @FT Dinner, Man vs Machine, Does It Have To Be Either/Or? #Davos2016 #WEF #WEFTalks

- Event Report: The Future Of Jobs From #Davos16 #WEF

- Event Report: The Transformation of Finance #Davos16 #WEF

- Event Report: A New Platform For The Digital Economy #Davos16 #WEF

- Monday’s Musings: Secrets Behind Building Any AI Driven Smart Service November 28, 2016

- Trends: Five Data Center Trends For 2017 November 12, 2016

- News Analysis: America In An @RealDonaldTrump Era – Everything International Clients Need To Know PESTEL Part 1. November 10, 2016

- Research Summary: Constellation’s AstroChart For Business Trends, Q4 2016 October 18, 2016

- Research Summary: Constellation’s AstroChart For Tech Trends October 17, 2016

- Monday’s Musings: Secrets Behind Building Any AI Driven Smart Service

- Monday’s Musings: Understand The Spectrum Of Seven Artificial Intelligence Outcomes

- Tuesday’s Tip: Seven Factors For Precision Decisions In Artificial Intelligence

- Monday’s Musings: Data – The Foundation Of Real-Time Digital Business

- ‘Monday’s Musings: Who Gets To Be A Chief Digital Officer?

- Monday’s Musings: CXOs Seek Enterprise-Grade Mobile Solutions Despite Seven Barriers August 16, 2016

- Research Summary: [VIDEO] Inside Constellation’s Futurist Framework August 9, 2016

- Best Practices: Five Critical Success Factors To Digital Transformation July 10, 2016

- Monday’s Musings: The Post #BREXIT Analysis, What’s Next? June 27, 2016

- Monday’s Musings: Data – The Foundation Of Real-Time Digital Business May 23, 2016

- Research Summary: The Algorithm of You – How IoT Transforms and Differentiates Customer Experience May 12, 2016

- Research Summary: HOLMES Puts Wipro in the Forefront of Cognitive Computing May 10, 2016

- Research Summary: Why Live Engagement Marketing Supercharges Event Marketing May 6, 2016

- Monday’s Musings: Why Digital Transformation Must Move Beyond The Hiring Of A Chief Digital Officer April 25, 2016

- Monday’s Musings: The Four Personas Of The Modern CMO In A Digital World April 11, 2016

- Monday’s Musings: The Seven Rules For Digital Business And Digital Transformation

- Tuesday’s Tip: Five Steps To Starting Your Digital Transformation Initiative

- Monday’s Musings: What Organizations Want From Mobile

- Research Summary: Economic Trends Exacerbate Digital Business Disruption And Digital Transformation (The Futurist Framework Part 3)

- Research Summary: Five Societal Shifts Showcase The Digital Divide Ahead (The Futurist Framework Part 2)

- Research Summary: Sneak Peaks From Constellation’s Futurist Framework And 2014 Outlook On Digital Disruption

- Research Report: Digital ARTISANs – The Seven Building Blocks Behind Building A Digital Business DNA

- Research Summary: Five Societal Shifts Showcase The Digital Divide Ahead (The Futurist Framework Part 2)

- Research Summary: Next Generation CIOs Aspire To Focus More On Innovation And The Chief Digital Officer Role

- Trends: [VIDEO] The Digital Business Disruption Ahead Preview – NASSCOM India Leadership Forum (#NASSCOM_ILF)

- Harvard Business Review: What a Big Data Business Model Looks Like

- Monday’s Musings: How The Five Consumer Tech Macro Pillars Influence Enterprise Software Innovation

- Tuesday’s Tip: Understand The Five Generation Of Digital Workers And Customers

- Monday’s Musings: The Chief Digital Officer In The Age Of Digital Business

- Slide Share: The CMO vs CIO – Pathways To Collaboration

- Research Summary And Speaker Notes: The Identity Manifesto – Why Identity Is At The Heart of Digital Business

Reprints

Reprints can be purchased through Constellation Research, Inc. To request official reprints in PDF format, please contact Sales .

Disclosure

Although we work closely with many mega software vendors, we want you to trust us. For the full disclosure policy,stay tuned for the full client list on the Constellation Research website.

* Not responsible for any factual errors or omissions. However, happy to correct any errors upon email receipt.

Copyright © 2001 -2017 R Wang and Insider Associates, LLC All rights reserved.

Contact the Sales team to purchase this report on a a la carte basis or join the Constellation Customer Experience

R "Ray" Wang

R "Ray" Wang R "Ray" Wang

R "Ray" Wang