News Analysis: Celonis Launches Execution Management System

Eliminating System Complexity Is Celonis' Number One Priority

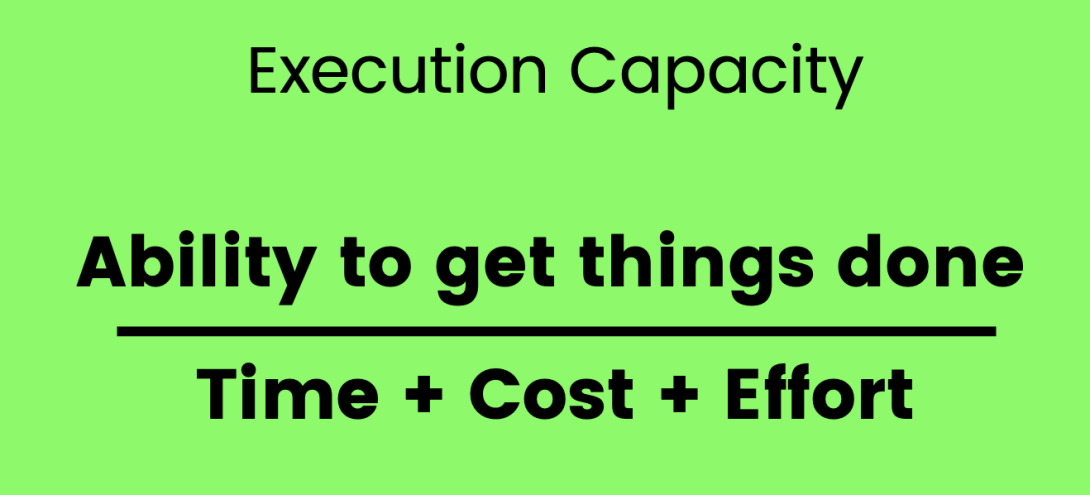

On October 14th, 2020, Co-CEO and Co-Founder, Alexander Rinke, kicked off its Ecosystem Summit and showcased its new Execution Management System (EMS). The goal is to improve an enterprise's execution capacity by simplifying complex processes. Celonis defines execution capacity as the ability to get things done over the time + cost + effort (see Figure 1).

Figure 1. Celonis Defines Execution Capacity Source: Celonis

Source: Celonis

Celonis uses its process mining core to deliver the Celonis EMS Platform. The Bavarian software startup is headquartered in Munich, Germany and New York City, USA with 15 offices worldwide.

The Celonis Execution Management System

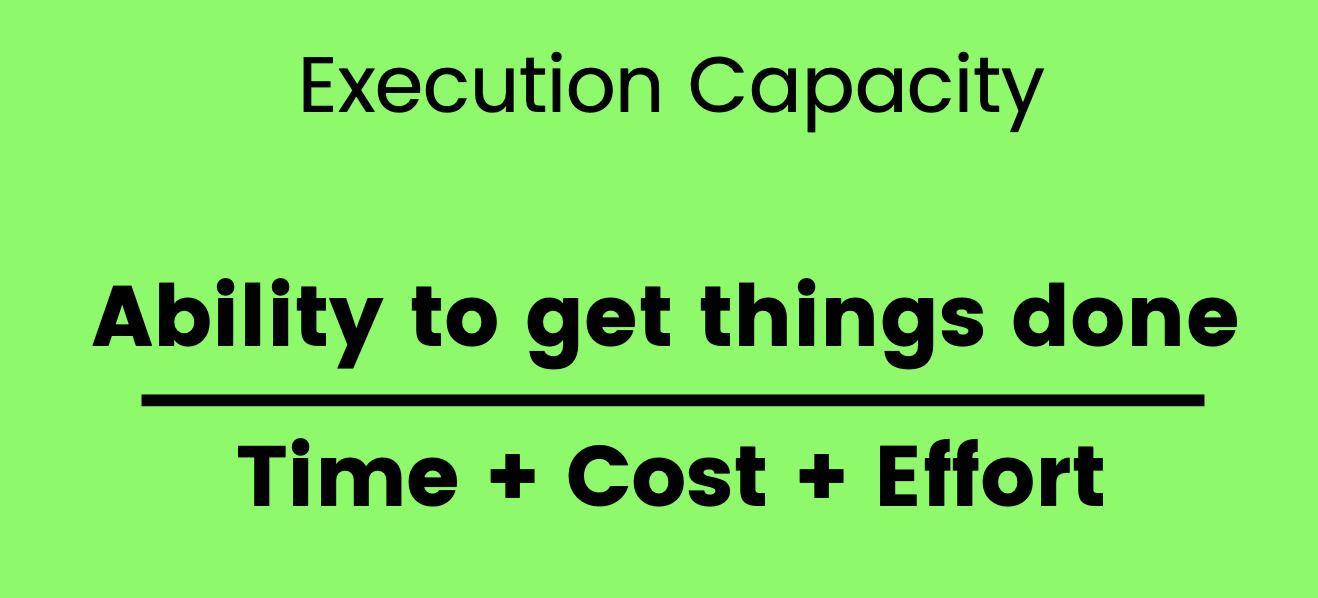

The Celonis Execution Management System (EMS) brings together a number of applications, instruments, development studios, tools and platform approaches to unlock execution capacity. Sitting on top of business processes and systems, the heart of the solution is the process mining core that identifies and measures capacity barriers. Capacity is unlocked by a methodic approach to applying best practices, actions, and automation. The new additions and updates from the fall launch of EMS include:

- Celonis Execution Applications. These operational applications include popular apps such as Celonis Accounts Payable, Accounts Receivable, and Opportunity Management.

- Celonis Execution Instruments. What was formerly known as process mining analytics applications, can be used to measure current execution capacity and identify execution gaps. Over 170 instruments have been developed to date.

- Celonis Studio. Ecosystem partners and customers use the studio to build new instruments and applications.

- Celonis EMS Store. New solutions can be ecosystem partners can be found in the store

Figure 2. Inside The Celonis EMS Platform

Source: Celonis

Proof Is In The Pudding

At the Ecosystem Summit, Celonis showcased a number of use cases where EMS improved operations. For example, AVNET reduced throughput times order management by 50% from order to ship. Dell was able to move to a leaner supply chain with 8 days of inventory versus an industry average of 40 days. Ascend improved on time delivery by 27% while simultaneously increasing automation by 43% in just four months. L'Oreal was able to grow on-time touchless orders by 800%, resulting in greater revenue and capacity to ship more products using existing infrastructure. Comcast improved asset utilization and captured $85 million in improvements.

Overall, this ability to improve execution capacity has created more capacity with existing infrastructure. In supply chains, the average on-time delivery rate is 43%, yet Celonis customers using EMS can hit a 95% target. Celonis clams that the average touchless invoice rate is only 27% inside companies while Celonis best-in-class customers are exceeding 90% adoption for finance and administration use cases. In customer experience, most companies average a 32 net promoter score (NPS), yet Celonis best-in-class customers appear to double scores at an average of 70 NPS.

Celonis customers include venerable brands such as ABB, AstraZeneca, Bosch, Coca Cola, Citibank, Dell, GSK, John Deere, L'Oreal, Siemens, Uber, Vodafone and Whirlpool (see Figure 3)

Figure 3. Celonis Customers Include Global Leaders In Every Industry

Source: Celonis

Bottom Line: The Race To Business Graphs Is Here, Automation and AI are The Facilitators To Decision Velocity.

The convergence of workflow, process mining, robotic process automation, integration services, microservices, and low-code/no-code platforms drive the future of software. This next battle in enterprise software will be the creation of business graphs. Like social graphs which use social networks to provide signal intelligence and digital feedback loops to accumulate massive amounts of data that is mined by AI, business graphs will accomplish the same for enterprises.

In the case of the enterprise, the relationships among users, documents, business processes, and contextual data will power the signal intelligence and digital feedback loops. As the majority of data is collected by digital feedback loops via automated and ambient collection, these systems can improve their precision decision capabilities. Automation and AI are the tools that bring scale to creating decision velocity.

Your POV

How has your experience with Celonis been? Do you feel they have the chops to take process mining to the next level? How are you using Celonis and will you adopt their execution management system?

Add your comments to the blog or reach me via email: R (at) ConstellationR (dot) com or R (at) SoftwareInsider (dot) org. Please let us know if you need help with your AI and Digital Business transformation efforts. Here’s how we can assist:

- Developing your digital business strategy

- Connecting with other pioneers

- Sharing best practices

- Vendor selection

- Implementation partner selection

- Providing contract negotiations and software licensing support

- Demystifying software licensing

Reprints can be purchased through Constellation Research, Inc. To request official reprints in PDF format, please contact Sales.

Resources And Related Research

- Product Review: Apple’s M1 MacBook Pro 13″, November 26, 2020

- News Analysis: Oracle Allegedly Wins Bid For TikTok, September 13, 2020

- News Analysis: Salesforce Commerce Cloud Intends To Acquire Mobify for Progressive Web Apps, September 6, 2020

- Event Report: Broadcom Mainframe Innovation World Tour, July 30, 2020

- Tuesday’s Tip: Virtual Meeting Best Practices, July 14, 2020

- Monday’s Musings: The Death of Density As A Business Model And What To Do About It, July 13, 2020

- News Analysis: Uber Eats Postmates for $2.65B, July 7, 2020

- News Analysis: Apple Brings New Post Pandemic Solutions To Remote Learning, May 31, 2020

- Salesforce Commerce Cloud Quick Start Addresses Post Pandemic Requirements, May 21, 2020

- Monday’s Musings: The Matrix Commerce Post Pandemic Playbook #COVID19, April 26 2020

- Monday’s Musings: Why Every Organization Must Build A Post Pandemic Playbook #COVID19 #CoronaVirus, April 6, 2020

- News Analysis: Tech Vendors Take On #Coronavirus, March 23, 2020

- Monday’s Musings: Inside The Five Levels Of Autonomous Enterprises March 22, 2020

- Personal Log: Understanding Case Fatality Rates For #COVID19 March 7, 2020

- Best Practices: Hosting Events In The Age Of #Coronavirus (COVID-19)

- Big Idea: Extreme Capitalism And The Dawn Of Digital Duopolies May 4, 2019

- Event Report: #WEF19 #Davos2019 Globalization 4.0 Under Fire As Global Leaders Fail The Populace January 22, 2019

- Research Report: Improving Go-to-Market Results with Constellation’s ACF January 16, 2019

- Event Report: Retailers Navigate Exponential Tech Amidst New Business Model Shifts #NRF2019 January 16, 2019

- Trends: Constellation 2018 Enterprise Awards January 3, 2019

- Monday’s Musings: What’s Up With Big Tech Stocks? The Insider View For 2019 December 24, 2018

- Big Idea: December 10th, The Future Of The Internet And Human Rights In A Digital Age November 26, 2018

- Event Report: @GCPCloud A Few Steps Closer To Enterprise Ready #GoogleNext18 July 27, 2018

- Best Practices: Seven Steps To Success In Enterprise Blockchain June 21, 2018

- Monday’s Musings: Seven Common Failures Plague Board Room Strategy In Digital Transformation May 7, 2018

- Monday’s Musings: Designing Five Pillars For Level 1 Artificial Intelligence Ethics March 26, 2018

- Digital Transformation Digest: Amazon AR View For Android, SAP Leonardo In Telecom and Cars, MIT AI Chip Makes Neural Networks Mobile February 27, 2018

- Digital Transformation Digest: Mobile World Congress and 5G, Samsung Galaxy S9 and Google Assistant Gets A Boost February 26, 2018

- Event Report: Microsoft Biz Apps Analyst Day Highlights Strategic Transformation #MSBizApps February 14, 2018

- Digital Transformation Digest: Oracle Bets Big On Cloud, Eye On Amazon Domination, and New Investments In Enterprise Tech February 13, 2018

- Digital Transformation Digest: Arizona Accepts Crypto For Tax, Google Rumored With iMessage Competitor, HomePods Sound Good February 12, 2018

- Research Report: Constellation’s Futurist Framework (PESTEL) – The Societal Outlook Pre @Davos #WEF18 January 18, 2018

- Research Report: Constellation’s Futurist Framework (PESTEL) – The Economic Outlook Pre @Davos #WEF18 January 17, 2018

- Research Report: Constellation’s Futurist Framework (PESTEL) – The Political Outlook Pre @Davos #WEF18 January 16, 2018

- Monday’s Musings: Want AI Ethics? Learn From These Four Movies/TV Shows! December 3, 2017

- Research Report: Demystifying Artificial Intelligence November 16, 2017

- Personal Log: What I’m Thankful For This Year November 23, 2017

- Monday’s Musing: Infinite Ambient Orchestration November 6, 2017

- Tuesday’s Tip: Know When To Automate With Artificial Intelligence September 19, 2017

- Personal Log: Congratulations To Constellation’s BT-150 Winners #BT150 September 6, 2017

- Event Invitation: Radical Candor Author Kim Scott Delivering Keynote at Connected Enterprise 2017 August 29, 2017

- Monday’s Musings: Part 1 of 4 – What Top CMO’s Care About (Demand Gen Persona) August 28, 2017

- Research Summary: Nine Starting Points For Digital Transformation In Manufacturing May 10, 2017

- Research Summary: Artificial Intelligence Delivers Mass Personalization In Commerce April 17, 2017

- Event Report: NASSCOM #NILF17 Highlights Need For Re-Skilling And Move Beyond Trump February 18, 2017

- Personal Log: Leading CXO Influencer, Dion Hinchcliffe (@dhinchcliffe) Joins Constellation Research April 3, 2017

- Tuesday’s Tip: Seven Universal Factors Why Technology Firms Fail January 10, 2017

- Monday’s Musings: Dynamic Leadership – A Responsive And Responsible Approach #Davos #WEF17 January 2, 2017

- Monday’s Musings: Why A Bi-Modal Approach to Digital Transformation Is Just Stupid December 12, 2016

- Monday’s Musings: Secrets Behind Building Any AI Driven Smart Service November 28, 2016

- Trends: Five Data Center Trends For 2017 November 12, 2016

- News Analysis: America In An @RealDonaldTrump Era – Everything International Clients Need To Know PESTEL Part 1. November 10, 2016

- Research Summary: Constellation’s AstroChart For Business Trends, Q4 2016 October 18, 2016

- Research Summary: Constellation’s AstroChart For Tech Trends October 17, 2016

- News Analysis: @Adobe @Microsoft Partner Up For Marketing Cloud, Azure and #AI #MSIgnite September 26, 2016

- Monday’s Musings: Understand The Spectrum Of Seven Artificial Intelligence Outcomes September 18, 2016

- Tuesday’s Tip: Seven Factors For Precision Decisions In Artificial Intelligence August 23, 2016

- Monday’s Musings: CXOs Seek Enterprise-Grade Mobile Solutions Despite Seven Barriers August 16, 2016

- Research Summary: [VIDEO] Inside Constellation’s Futurist Framework August 9, 2016

- Best Practices: Five Critical Success Factors To Digital Transformation July 10, 2016

- Monday’s Musings: The Post #BREXIT Analysis, What’s Next? June 27, 2016

- Personal Log: Pulse Shootings And The State Of America June 12, 2016

- Monday’s Musings: Data – The Foundation Of Real-Time Digital Business May 23, 2016

- Research Summary: The Algorithm of You – How IoT Transforms and Differentiates Customer Experience May 12, 2016

- Research Summary: Why Live Engagement Marketing Supercharges Event Marketing May 6, 2016

- Monday’s Musings: Why Digital Transformation Must Move Beyond The Hiring Of A Chief Digital Officer April 25, 2016

- Monday’s Musings: The Four Personas Of The Modern CMO In A Digital World April 11, 2016

- Event Report: A New Platform For The Digital Economy #Davos16 #WEF January 28, 2016

- Event Report: The Transformation of Finance #Davos16 #WEF January 28, 2016

- Event Report: The Future Of Jobs From #Davos16 #WEF January 20, 2016

- Event Report: The @Wipro @FT Dinner, Man vs Machine, Does It Have To Be Either/Or? #Davos2016 #WEF #WEFTalks January 19, 2016

- Event Report: The Weekend Before Davos And The Dawn Of The Fourth Industrial Revolution January 16, 2016

- News Analysis: In Search Of Growth Amidst Digital Disruption January 8, 2016

- Monday’s Musings: Reflecting On Five Years Of Disrupting The Industry Analyst Business November 16, 2015

- Monday’s Musings: Avoiding Cloud Vendor Lock-In October 25, 2015

- Monday’s Musings: Dealing With The Startup Who Went Public And Is Now Arrogant As Hell October 11, 2015

- Tuesday’s Tip: IOT and The Death Of OmniChannel Non-sense In Customer Experience September 22, 2015

- Event Invitation: Webinar on The American Eagle Story- Competing On Experiences And Outcomes In A Mobile World September 15, 2015

- Event Invitation: Tweet Chat on Managing #ShadowIT September 6, 2015

- Event Invitation: Come Join Us For A Silicon Valley CXO Day At Constellation’s Connected Enterprise #CCE2015 August 26, 2015

- News Analysis: Inside The Rationale Behind @LinkedIn Turning Off Its CSV Connections Download Tool July 25, 2015

- News Analysis: How @LinkedIn Is Creating A Personal Data Hostage Crisis For Its Users July 25, 2015

- Tuesday’s Tip: Apply For A SuperNova Award – Recognize Leaders In Digital Business July 21, 2015

- Book Summary: Lesson 10 From Disrupting Digital Business – Segment By Digital Proficiency Not Age July 12, 2015

- Book Summary: Lesson 9 From Disrupting Digital Business – Deliver Intention Driven, Mass Personalization At Scale July 2, 2015

- Book Summary: Lesson 8 From Disrupting Digital Business – Democratize Distribution With P2P Networks June 22, 2015

- Webinar Invite: Delivering on Continuity – The Future of Marketing June 15, 2015

- Book Summary: Lesson 7 From Disrupting Digital Business – Humanize Digital With Digital Artisans June 14, 2015

- Book Summary: Lesson 6 From Disrupting Digital Business – Win With Network Economies June 10, 2015

Disclosures

Although we work closely with many mega software vendors, we want you to trust us. For the full disclosure policy,stay tuned for the full client list on the Constellation Research website. * Not responsible for any factual errors or omissions. However, happy to correct any errors upon email receipt.

Constellation Research recommends that readers consult a stock professional for their investment guidance. Investors should understand the potential conflicts of interest analysts might face. Constellation does not underwrite or own the securities of the companies the analysts cover. Analysts themselves sometimes own stocks in the companies they cover—either directly or indirectly, such as through employee stock-purchase pools in which they and their colleagues participate. As a general matter, investors should not rely solely on an analyst’s recommendation when deciding whether to buy, hold, or sell a stock. Instead, they should also do their own research—such as reading the prospectus for new companies or for public companies, the quarterly and annual reports filed with the SEC—to confirm whether a particular investment is appropriate for them in light of their individual financial circumstances.

Copyright © 2001 – 2020 R Wang and Insider Associates, LLC All rights reserved.

Contact the Sales team to purchase this report on a a la carte basis or join the Constellation Executive Network

R "Ray" Wang

R "Ray" Wang R "Ray" Wang

R "Ray" Wang